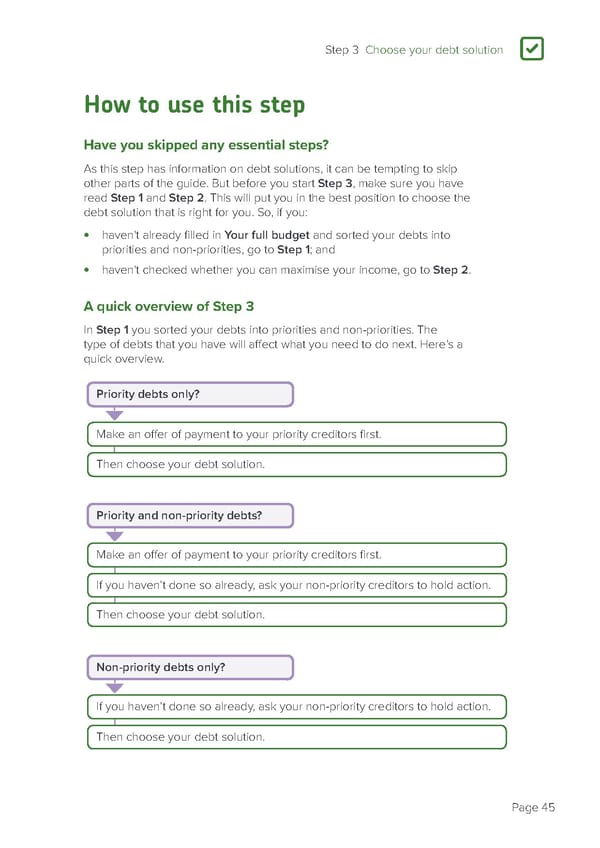

Step 3 Choose your debt solution 3 How to use this step Have you skipped any essential steps? As this step has information on debt solutions, it can be tempting to skip other parts of the guide. But before you start Step 3, make sure you have read Step 1 and Step 2. This will put you in the best position to choose the debt solution that is right for you. So, if you: • haven't already filled in Your full budget and sorted your debts into priorities and non-priorities, go to Step 1; and • haven't checked whether you can maximise your income, go to Step 2. A quick overview of Step 3 In Step 1 you sorted your debts into priorities and non-priorities. The type of debts that you have will affect what you need to do next. Here’s a quick overview. Priority debts only? Make an offer of payment to your priority creditors first. Then choose your debt solution. Priority and non-priority debts? Make an offer of payment to your priority creditors first. If you haven’t done so already, ask your non-priority creditors to hold action. Then choose your debt solution. Non-priority debts only? If you haven’t done so already, ask your non-priority creditors to hold action. Then choose your debt solution. Page 45

how-to-deal-with-debt Page 46 Page 48

how-to-deal-with-debt Page 46 Page 48