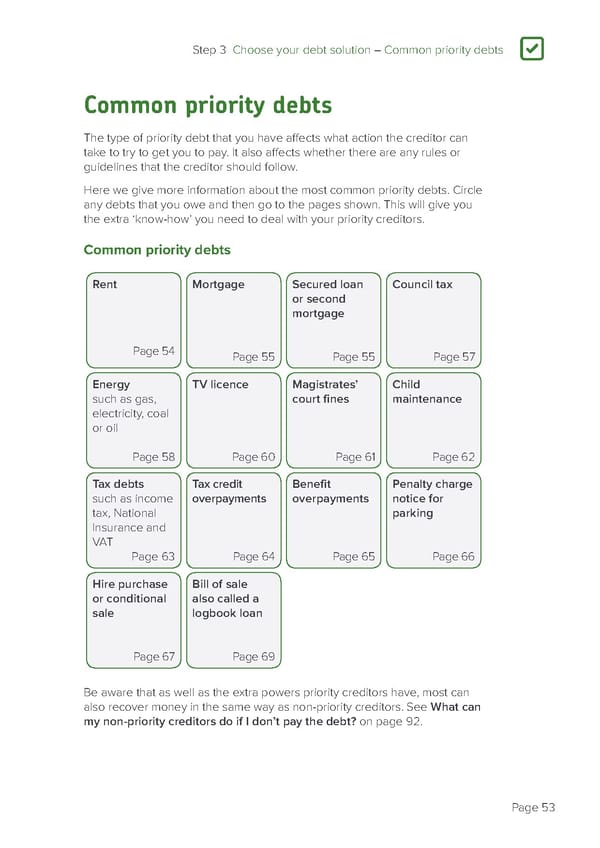

Step 3 Choose your debt solution – Common priority debts 3 Common priority debts The type of priority debt that you have affects what action the creditor can take to try to get you to pay. It also affects whether there are any rules or guidelines that the creditor should follow. Here we give more information about the most common priority debts. Circle any debts that you owe and then go to the pages shown. This will give you the extra ‘know-how’ you need to deal with your priority creditors. Common priority debts Rent Mortgage Secured loan Council tax or second mortgage Page 54 Page 55 Page 55 Page 57 Energy TV licence Magistrates’ Child such as gas, court fines maintenance electricity, coal or oil Page 58 Page 60 Page 61 Page 62 Tax debts Tax credit Benefit Penalty charge such as income overpayments overpayments notice for tax, National parking Insurance and VAT Page 63 Page 64 Page 65 Page 66 Hire purchase Bill of sale or conditional also called a sale logbook loan Page 67 Page 69 Be aware that as well as the extra powers priority creditors have, most can also recover money in the same way as non-priority creditors. See What can my non-priority creditors do if I don’t pay the debt? on page 92. Page 53

how-to-deal-with-debt Page 54 Page 56

how-to-deal-with-debt Page 54 Page 56