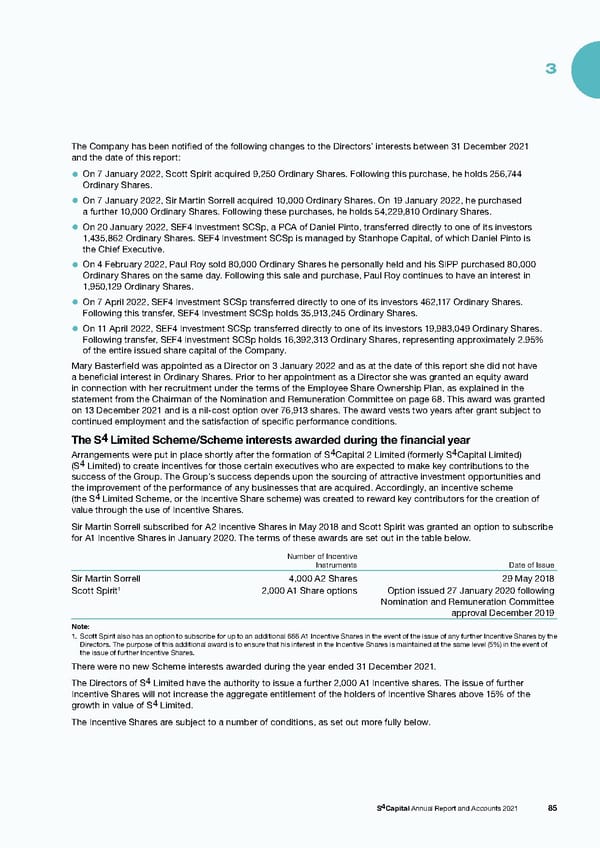

3 The Company has been notified of the following changes to the Directors’ interests between 31 December 2021 and the date of this report: • On 7 January 2022, Scott Spirit acquired 9,250 Ordinary Shares. Following this purchase, he holds 256,744 Ordinary Shares. • On 7 January 2022, Sir Martin Sorrell acquired 10,000 Ordinary Shares. On 19 January 2022, he purchased a further 10,000 Ordinary Shares. Following these purchases, he holds 54,229,810 Ordinary Shares. • On 20 January 2022, SEF4 Investment SCSp, a PCA of Daniel Pinto, transferred directly to one of its investors 1,435,862 Ordinary Shares. SEF4 Investment SCSp is managed by Stanhope Capital, of which Daniel Pinto is the Chief Executive. • On 4 February 2022, Paul Roy sold 80,000 Ordinary Shares he personally held and his SIPP purchased 80,000 Ordinary Shares on the same day. Following this sale and purchase, Paul Roy continues to have an interest in 1,950,129 Ordinary Shares. • On 7 April 2022, SEF4 Investment SCSp transferred directly to one of its investors 462,117 Ordinary Shares. Following this transfer, SEF4 Investment SCSp holds 35,913,245 Ordinary Shares. • On 11 April 2022, SEF4 Investment SCSp transferred directly to one of its investors 19,983,049 Ordinary Shares. Following transfer, SEF4 Investment SCSp holds 16,392,313 Ordinary Shares, representing approximately 2.95% of the entire issued share capital of the Company. Mary Basterfield was appointed as a Director on 3 January 2022 and as at the date of this report she did not have a beneficial interest in Ordinary Shares. Prior to her appointment as a Director she was granted an equity award in connection with her recruitment under the terms of the Employee Share Ownership Plan, as explained in the statement from the Chairman of the Nomination and Remuneration Committee on page 68. This award was granted on 13 December 2021 and is a nil-cost option over 76,913 shares. The award vests two years after grant subject to continued employment and the satisfaction of specific performance conditions. 4 The S Limited Scheme/Scheme interests awarded during the financial year Arrangements were put in place shortly after the formation of S4Capital 2 Limited (formerly S4Capital Limited) 4 (S Limited) to create incentives for those certain executives who are expected to make key contributions to the success of the Group. The Group’s success depends upon the sourcing of attractive investment opportunities and the improvement of the performance of any businesses that are acquired. Accordingly, an incentive scheme 4 (the S Limited Scheme, or the Incentive Share scheme) was created to reward key contributors for the creation of value through the use of Incentive Shares. Sir Martin Sorrell subscribed for A2 Incentive Shares in May 2018 and Scott Spirit was granted an option to subscribe for A1 Incentive Shares in January 2020. The terms of these awards are set out in the table below. Number of Incentive Instruments Date of Issue Sir Martin Sorrell 4,000 A2 Shares 29 May 2018 1 Scott Spirit 2,000 A1 Share options Option issued 27 January 2020 following Nomination and Remuneration Committee approval December 2019 Note: 1. Scott Spirit also has an option to subscribe for up to an additional 666 A1 Incentive Shares in the event of the issue of any further Incentive Shares by the Directors. The purpose of this additional award is to ensure that his interest in the Incentive Shares is maintained at the same level (5%) in the event of the issue of further Incentive Shares. There were no new Scheme interests awarded during the year ended 31 December 2021. 4 The Directors of S Limited have the authority to issue a further 2,000 A1 Incentive shares. The issue of further Incentive Shares will not increase the aggregate entitlement of the holders of Incentive Shares above 15% of the 4 growth in value of S Limited. The Incentive Shares are subject to a number of conditions, as set out more fully below. S4Capital Annual Report and Accounts 2021 85

s4 capital annual report and accounts 2021 Page 86 Page 88

s4 capital annual report and accounts 2021 Page 86 Page 88