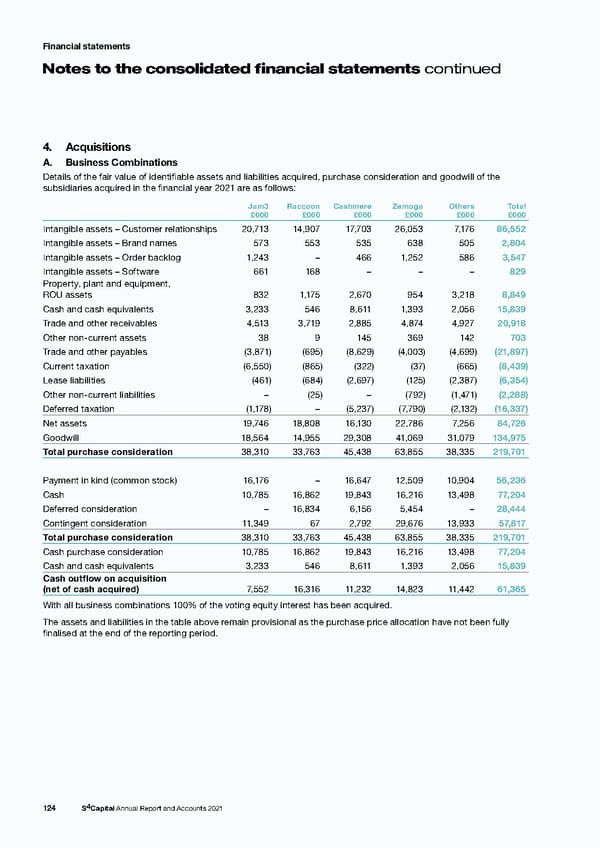

Financial statements N otes to the consolidated financial statements continued 4. Acquisitions A. Business Combinations Details of the fair value of identifiable assets and liabilities acquired, purchase consideration and goodwill of the subsidiaries acquired in the financial year 2021 are as follows: Jam3 Raccoon Cashmere Zemoga Others Total £000 £000 £000 £000 £000 £000 Intangible assets – Customer relationships 20,713 14,907 17,703 26,053 7,176 86,552 Intangible assets – Brand names 573 553 535 638 505 2,804 Intangible assets – Order backlog 1,243 – 466 1,252 586 3,547 Intangible assets – Software 661 168 – – – 829 Property, plant and equipment, ROU assets 832 1,175 2,670 954 3,218 8,849 Cash and cash equivalents 3,233 546 8,611 1,393 2,056 15,839 Trade and other receivables 4,513 3,719 2,885 4,874 4,927 20,918 Other non-current assets 38 9 145 369 142 703 Trade and other payables (3,871) (695) (8,629) (4,003) (4,699) (21,897) Current taxation (6,550) (865) (322) (37) (665) (8,439) Lease liabilities (461) (684) (2,697) (125) (2,387) (6,354) Other non-current liabilities – (25) – (792) (1,471) (2,288) Deferred taxation (1,178) – (5,237) ( 7,790) ( 2,132) (16,337) Net assets 19,746 18,808 16,130 22,786 7,256 84,726 Goodwill 18,564 14,955 29,308 41,069 31,079 134,975 Total purchase consideration 38,310 33,763 45,438 63,855 38,335 219,701 Payment in kind (common stock) 16,176 – 16,647 12,509 10,904 56,236 Cash 10,785 16,862 19,843 16,216 13,498 77,204 Deferred consideration – 16,834 6,156 5,454 – 28,444 Contingent consideration 11,349 67 2,792 29,676 13,933 57,817 Total purchase consideration 38,310 33,763 45,438 63,855 38,335 219,701 Cash purchase consideration 10,785 16,862 19,843 16,216 13,498 77,204 Cash and cash equivalents 3,233 546 8,611 1,393 2,056 15,839 Cash outflow on acquisition (net of cash acquired) 7,552 16,316 11,232 14,823 11,442 61,365 With all business combinations 100% of the voting equity interest has been acquired. The assets and liabilities in the table above remain provisional as the purchase price allocation have not been fully finalised at the end of the reporting period. 124 S4Capital Annual Report and Accounts 2021

s4 capital annual report and accounts 2021 Page 125 Page 127

s4 capital annual report and accounts 2021 Page 125 Page 127