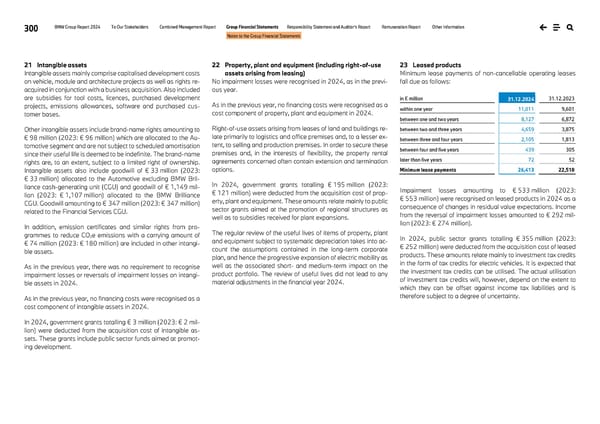

300 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Notes to the Group Financial Statements 21 Intangible assets Intangible assets mainly comprise capitalised development costs on vehicle, module and architecture projects as well as rights re- acquired in conjunction with a business acquisition. Also included are subsidies for tool costs, licences, purchased development projects, emissions allowances, software and purchased cus- tomer bases. Other intangible assets include brand-name rights amounting to € 98 million (2023: € 96 million) which are allocated to the Au- tomotive segment and are not subject to scheduled amortisation since their useful life is deemed to be indefinite. The brand-name rights are, to an extent, subject to a limited right of ownership. Intangible assets also include goodwill of € 33 million (2023: € 33 million) allocated to the Automotive excluding BMW Bril- liance cash-generating unit (CGU) and goodwill of € 1,149 mil- lion (2023: € 1,107 million) allocated to the BMW Brilliance CGU. Goodwill amounting to € 347 million (2023: € 347 million) related to the Financial Services CGU. In addition, emission certificates and similar rights from pro- grammes to reduce CO2e emissions with a carrying amount of € 74 million (2023: € 180 million) are included in other intangi- ble assets. As in the previous year, there was no requirement to recognise impairment losses or reversals of impairment losses on intangi- ble assets in 2024. As in the previous year, no financing costs were recognised as a cost component of intangible assets in 2024. In 2024, government grants totalling € 3 million (2023: € 2 mil- lion) were deducted from the acquisition cost of intangible as- sets. These grants include public sector funds aimed at promot- ing development. 22 Property, plant and equipment (including right-of-use assets arising from leasing) No impairment losses were recognised in 2024, as in the previ- ous year. As in the previous year, no financing costs were recognised as a cost component of property, plant and equipment in 2024. Right-of-use assets arising from leases of land and buildings re- late primarily to logistics and office premises and, to a lesser ex- tent, to selling and production premises. In order to secure these premises and, in the interests of flexibility, the property rental agreements concerned often contain extension and termination options. In 2024, government grants totalling € 195 million (2023: € 121 million) were deducted from the acquisition cost of prop- erty, plant and equipment. These amounts relate mainly to public sector grants aimed at the promotion of regional structures as well as to subsidies received for plant expansions. The regular review of the useful lives of items of property, plant and equipment subject to systematic depreciation takes into ac- count the assumptions contained in the long-term corporate plan, and hence the progressive expansion of electric mobility as well as the associated short- and medium-term impact on the product portfolio. The review of useful lives did not lead to any material adjustments in the financial year 2024. 23 Leased products Minimum lease payments of non-cancellable operating leases fall due as follows: in € million 31.12.2024 31.12.2023 within one year 11,011 9,601 between one and two years 8,127 6,872 between two and three years 4,659 3,875 between three and four years 2,105 1,813 between four and five years 439 305 later than five years 72 52 Minimum lease payments 26,413 22,518 Impairment losses amounting to € 533 million (2023: € 553 million) were recognised on leased products in 2024 as a consequence of changes in residual value expectations. Income from the reversal of impairment losses amounted to € 292 mil- lion (2023: € 274 million). In 2024, public sector grants totalling € 355 million (2023: € 252 million) were deducted from the acquisition cost of leased products. These amounts relate mainly to investment tax credits in the form of tax credits for electric vehicles. It is expected that the investment tax credits can be utilised. The actual utilisation of investment tax credits will, however, depend on the extent to which they can be offset against income tax liabilities and is therefore subject to a degree of uncertainty.

BMW Group Report 2024 Page 299 Page 301

BMW Group Report 2024 Page 299 Page 301