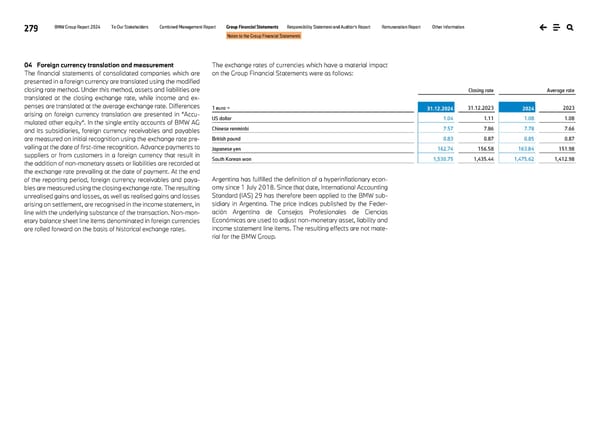

279 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Notes to the Group Financial Statements 04 Foreign currency translation and measurement The financial statements of consolidated companies which are presented in a foreign currency are translated using the modified closing rate method. Under this method, assets and liabilities are translated at the closing exchange rate, while income and ex- penses are translated at the average exchange rate. Differences arising on foreign currency translation are presented in “Accu- mulated other equity“. In the single entity accounts of BMW AG and its subsidiaries, foreign currency receivables and payables are measured on initial recognition using the exchange rate pre- vailing at the date of first-time recognition. Advance payments to suppliers or from customers in a foreign currency that result in the addition of non-monetary assets or liabilities are recorded at the exchange rate prevailing at the date of payment. At the end of the reporting period, foreign currency receivables and paya- bles are measured using the closing exchange rate. The resulting unrealised gains and losses, as well as realised gains and losses arising on settlement, are recognised in the income statement, in line with the underlying substance of the transaction. Non-mon- etary balance sheet line items denominated in foreign currencies are rolled forward on the basis of historical exchange rates. The exchange rates of currencies which have a material impact on the Group Financial Statements were as follows: Closing rate Average rate 1 euro = 31.12.2024 31.12.2023 2024 2023 US dollar 1.04 1.11 1.08 1.08 Chinese renminbi 7.57 7.86 7.78 7.66 British pound 0.83 0.87 0.85 0.87 Japanese yen 162.74 156.58 163.84 151.98 South Korean won 1,530.75 1,435.44 1,475.62 1,412.98 Argentina has fulfilled the definition of a hyperinflationary econ- omy since 1 July 2018. Since that date, International Accounting Standard (IAS) 29 has therefore been applied to the BMW sub- sidiary in Argentina. The price indices published by the Feder- ación Argentina de Consejos Profesionales de Ciencias Económicas are used to adjust non-monetary asset, liability and income statement line items. The resulting effects are not mate- rial for the BMW Group.

BMW Group Report 2024 Page 278 Page 280

BMW Group Report 2024 Page 278 Page 280