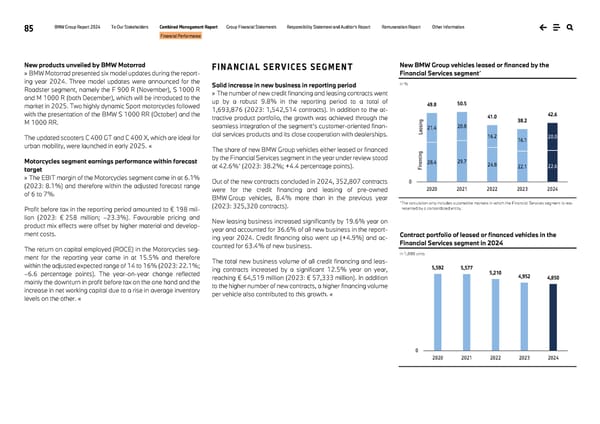

85 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Financial Performance New products unveiled by BMW Motorrad » BMW Motorrad presented six model updates during the report- ing year 2024. Three model updates were announced for the Roadster segment, namely the F 900 R (November), S 1000 R and M 1000 R (both December), which will be introduced to the market in 2025. Two highly dynamic Sport motorcycles followed with the presentation of the BMW S 1000 RR (October) and the M 1000 RR. The updated scooters C 400 GT and C 400 X, which are ideal for urban mobility, were launched in early 2025. « Motorcycles segment earnings performance within forecast target » The EBIT margin of the Motorcycles segment came in at 6.1% (2023: 8.1%) and therefore within the adjusted forecast range of 6 to 7%. Profit before tax in the reporting period amounted to € 198 mil- lion (2023: € 258 million; –23.3%). Favourable pricing and product mix effects were offset by higher material and develop- ment costs. The return on capital employed (ROCE) in the Motorcycles seg- ment for the reporting year came in at 15.5% and therefore within the adjusted expected range of 14 to 16% (2023: 22.1%; –6.6 percentage points). The year-on-year change reflected mainly the downturn in profit before tax on the one hand and the increase in net working capital due to a rise in average inventory levels on the other. « FINANCIAL SERVICES SEGMENT Solid increase in new business in reporting period » The number of new credit financing and leasing contracts went up by a robust 9.8% in the reporting period to a total of 1,693,876 (2023: 1,542,514 contracts). In addition to the at- tractive product portfolio, the growth was achieved through the seamless integration of the segment’s customer-oriented finan- cial services products and its close cooperation with dealerships. The share of new BMW Group vehicles either leased or financed by the Financial Services segment in the year under review stood at 42.6%* (2023: 38.2%; +4.4 percentage points). Out of the new contracts concluded in 2024, 352,807 contracts were for the credit financing and leasing of pre-owned BMW Group vehicles, 8.4% more than in the previous year (2023: 325,320 contracts). New leasing business increased significantly by 19.6% year on year and accounted for 36.6% of all new business in the report- ing year 2024. Credit financing also went up (+4.9%) and ac- counted for 63.4% of new business. The total new business volume of all credit financing and leas- ing contracts increased by a significant 12.5% year on year, reaching € 64,519 million (2023: € 57,333 million). In addition to the higher number of new contracts, a higher financing volume per vehicle also contributed to this growth. « New BMW Group vehicles leased or financed by the Financial Services segment* in % *The calculation only includes automobile markets in which the Financial Services segment is rep- resented by a consolidated entity. Contract portfolio of leased or financed vehicles in the Financial Services segment in 2024 in 1,000 units 28.4 29.7 24.8 22.1 22.6 21.4 20.8 16.2 16.1 20.0 49.8 50.5 41.0 38.2 42.6 0 2020 2021 2022 2023 2024 Financing Leasing 5,592 5,577 5,210 4,952 4,850 0 2020 2021 2022 2023 2024

BMW Group Report 2024 Page 84 Page 86

BMW Group Report 2024 Page 84 Page 86