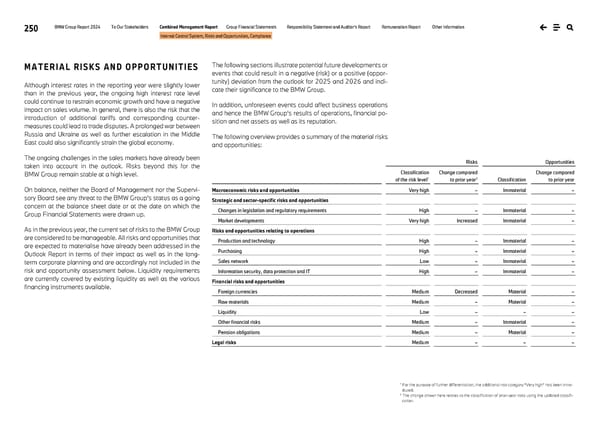

250 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Internal Control System, Risks and Opportunities, Compliance MATERIAL RISKS AND OPPORTUNITIES Although interest rates in the reporting year were slightly lower than in the previous year, the ongoing high interest rate level could continue to restrain economic growth and have a negative impact on sales volume. In general, there is also the risk that the introduction of additional tariffs and corresponding counter- measures could lead to trade disputes. A prolonged war between Russia and Ukraine as well as further escalation in the Middle East could also significantly strain the global economy. The ongoing challenges in the sales markets have already been taken into account in the outlook. Risks beyond this for the BMW Group remain stable at a high level. On balance, neither the Board of Management nor the Supervi- sory Board see any threat to the BMW Group’s status as a going concern at the balance sheet date or at the date on which the Group Financial Statements were drawn up. As in the previous year, the current set of risks to the BMW Group are considered to be manageable. All risks and opportunities that are expected to materialise have already been addressed in the Outlook Report in terms of their impact as well as in the long- term corporate planning and are accordingly not included in the risk and opportunity assessment below. Liquidity requirements are currently covered by existing liquidity as well as the various financing instruments available. The following sections illustrate potential future developments or events that could result in a negative (risk) or a positive (oppor- tunity) deviation from the outlook for 2025 and 2026 and indi- cate their significance to the BMW Group. In addition, unforeseen events could affect business operations and hence the BMW Group’s results of operations, financial po- sition and net assets as well as its reputation. The following overview provides a summary of the material risks and opportunities: Risks Opportunities Classification of the risk level1 Change compared to prior year2 Classification Change compared to prior year Macroeconomic risks and opportunities Very high – Immaterial – Strategic and sector-specific risks and opportunities Changes in legislation and regulatory requirements High – Immaterial – Market developments Very high Increased Immaterial – Risks and opportunities relating to operations Production and technology High – Immaterial – Purchasing High – Immaterial – Sales network Low – Immaterial – Information security, data protection and IT High – Immaterial – Financial risks and opportunities Foreign currencies Medium Decreased Material – Raw materials Medium – Material – Liquidity Low – – – Other financial risks Medium – Immaterial – Pension obligations Medium – Material – Legal risks Medium – – – 1 For the purpose of further differentiation, the additional risk category “Very high” has been intro- duced. 2 The change shown here relates to the classification of prior-year risks using the updated classifi- cation.

BMW Group Report 2024 Page 249 Page 251

BMW Group Report 2024 Page 249 Page 251