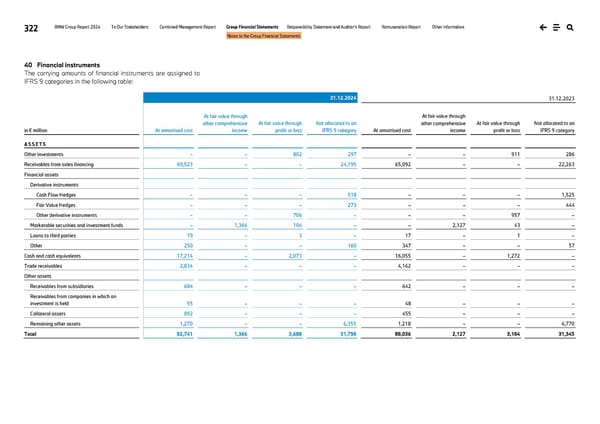

322 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Notes to the Group Financial Statements 40 Financial instruments The carrying amounts of financial instruments are assigned to IFRS 9 categories in the following table: 31.12.2024 31.12.2023 in € million At amortised cost At fair value through other comprehensive income At fair value through profit or loss Not allocated to an IFRS 9 category At amortised cost At fair value through other comprehensive income At fair value through profit or loss Not allocated to an IFRS 9 category A S S E T S Other investments – – 802 297 – – 911 286 Receivables from sales financing 69,523 – – 24,195 65,092 – – 22,263 Financial assets Derivative instruments Cash Flow Hedges – – – 518 – – – 1,525 Fair Value Hedges – – – 273 – – – 444 Other derivative instruments – – 706 – – – 957 – Marketable securities and investment funds – 1,366 104 – – 2,127 43 – Loans to third parties 19 – 3 – 17 – 1 – Other 250 – – 160 347 – – 57 Cash and cash equivalents 17,214 – 2,073 – 16,055 – 1,272 – Trade receivables 2,834 – – – 4,162 – – – Other assets Receivables from subsidiaries 684 – – – 642 – – – Receivables from companies in which an investment is held 55 – – – 48 – – – Collateral assets 892 – – – 455 – – – Remaining other assets 1,270 – – 6,355 1,218 – – 6,770 Total 92,741 1,366 3,688 31,798 88,036 2,127 3,184 31,345

BMW Group Report 2024 Page 321 Page 323

BMW Group Report 2024 Page 321 Page 323