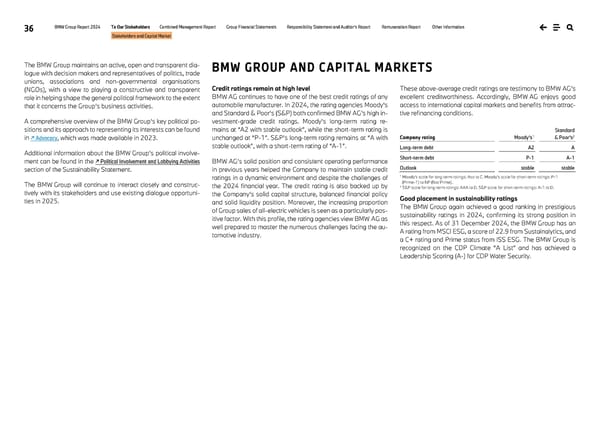

36 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Stakeholders and Capital Market The BMW Group maintains an active, open and transparent dia- logue with decision makers and representatives of politics, trade unions, associations and non-governmental organisations (NGOs), with a view to playing a constructive and transparent role in helping shape the general political framework to the extent that it concerns the Group’s business activities. A comprehensive overview of the BMW Group’s key political po- sitions and its approach to representing its interests can be found in ↗ Advocacy, which was made available in 2023. Additional information about the BMW Group’s political involve- ment can be found in the ↗ Political Involvement and Lobbying Activities section of the Sustainability Statement. The BMW Group will continue to interact closely and construc- tively with its stakeholders and use existing dialogue opportuni- ties in 2025. Credit ratings remain at high level BMW AG continues to have one of the best credit ratings of any automobile manufacturer. In 2024, the rating agencies Moody’s and Standard & Poor’s (S&P) both confirmed BMW AG’s high in- vestment-grade credit ratings. Moody’s long-term rating re- mains at “A2 with stable outlook”, while the short-term rating is unchanged at “P-1”. S&P’s long-term rating remains at “A with stable outlook”, with a short-term rating of “A-1”. BMW AG’s solid position and consistent operating performance in previous years helped the Company to maintain stable credit ratings in a dynamic environment and despite the challenges of the 2024 financial year. The credit rating is also backed up by the Company’s solid capital structure, balanced financial policy and solid liquidity position. Moreover, the increasing proportion of Group sales of all-electric vehicles is seen as a particularly pos- itive factor. With this profile, the rating agencies view BMW AG as well prepared to master the numerous challenges facing the au- tomotive industry. These above-average credit ratings are testimony to BMW AG’s excellent creditworthiness. Accordingly, BMW AG enjoys good access to international capital markets and benefits from attrac- tive refinancing conditions. Company rating Moody’s1 Standard & Poor’s2 Long-term debt A2 A Short-term debt P-1 A-1 Outlook stable stable 1 Moody’s scale for long-term ratings: Aaa to C. Moody’s scale for short-term ratings: P-1 (Prime-1) to NP (Not Prime). 2 S&P scale for long-term ratings: AAA to D. S&P scale for short-term ratings: A-1 to D. Good placement in sustainability ratings The BMW Group again achieved a good ranking in prestigious sustainability ratings in 2024, confirming its strong position in this respect. As of 31 December 2024, the BMW Group has an A rating from MSCI ESG, a score of 22.9 from Sustainalytics, and a C+ rating and Prime status from ISS ESG. The BMW Group is recognized on the CDP Climate “A List” and has achieved a Leadership Scoring (A-) for CDP Water Security. BMW GROUP AND CAPITAL MARKETS

BMW Group Report 2024 Page 35 Page 37

BMW Group Report 2024 Page 35 Page 37