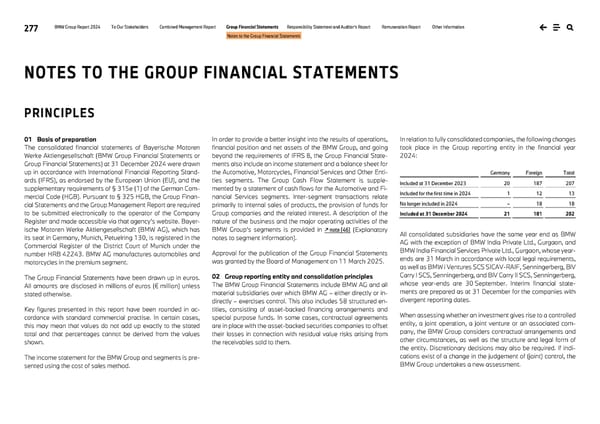

277 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Notes to the Group Financial Statements PRINCIPLES 01 Basis of preparation The consolidated financial statements of Bayerische Motoren Werke Aktiengesellschaft (BMW Group Financial Statements or Group Financial Statements) at 31 December 2024 were drawn up in accordance with International Financial Reporting Stand- ards (IFRS), as endorsed by the European Union (EU), and the supplementary requirements of § 315e (1) of the German Com- mercial Code (HGB). Pursuant to § 325 HGB, the Group Finan- cial Statements and the Group Management Report are required to be submitted electronically to the operator of the Company Register and made accessible via that agency’s website. Bayer- ische Motoren Werke Aktiengesellschaft (BMW AG), which has its seat in Germany, Munich, Petuelring 130, is registered in the Commercial Register of the District Court of Munich under the number HRB 42243. BMW AG manufactures automobiles and motorcycles in the premium segment. The Group Financial Statements have been drawn up in euros. All amounts are disclosed in millions of euros (€ million) unless stated otherwise. Key figures presented in this report have been rounded in ac- cordance with standard commercial practise. In certain cases, this may mean that values do not add up exactly to the stated total and that percentages cannot be derived from the values shown. The income statement for the BMW Group and segments is pre- sented using the cost of sales method. In order to provide a better insight into the results of operations, financial position and net assets of the BMW Group, and going beyond the requirements of IFRS 8, the Group Financial State- ments also include an income statement and a balance sheet for the Automotive, Motorcycles, Financial Services and Other Enti- ties segments. The Group Cash Flow Statement is supple- mented by a statement of cash flows for the Automotive and Fi- nancial Services segments. Inter-segment transactions relate primarily to internal sales of products, the provision of funds for Group companies and the related interest. A description of the nature of the business and the major operating activities of the BMW Group’s segments is provided in ↗ note [46] (Explanatory notes to segment information). Approval for the publication of the Group Financial Statements was granted by the Board of Management on 11 March 2025. 02 Group reporting entity and consolidation principles The BMW Group Financial Statements include BMW AG and all material subsidiaries over which BMW AG – either directly or in- directly – exercises control. This also includes 58 structured en- tities, consisting of asset-backed financing arrangements and special purpose funds. In some cases, contractual agreements are in place with the asset-backed securities companies to offset their losses in connection with residual value risks arising from the receivables sold to them. In relation to fully consolidated companies, the following changes took place in the Group reporting entity in the financial year 2024: Germany Foreign Total Included at 31 December 2023 20 187 207 Included for the first time in 2024 1 12 13 No longer included in 2024 – 18 18 Included at 31 December 2024 21 181 202 All consolidated subsidiaries have the same year end as BMW AG with the exception of BMW India Private Ltd., Gurgaon, and BMW India Financial Services Private Ltd., Gurgaon, whose year- ends are 31 March in accordance with local legal requirements, as well as BMW i Ventures SCS SICAV-RAIF, Senningerberg, BiV Carry I SCS, Senningerberg, and BiV Carry II SCS, Senningerberg, whose year-ends are 30 September. Interim financial state- ments are prepared as at 31 December for the companies with divergent reporting dates. When assessing whether an investment gives rise to a controlled entity, a joint operation, a joint venture or an associated com- pany, the BMW Group considers contractual arrangements and other circumstances, as well as the structure and legal form of the entity. Discretionary decisions may also be required. If indi- cations exist of a change in the judgement of (joint) control, the BMW Group undertakes a new assessment. NOTES TO THE GROUP FINANCIAL STATEMENTS

BMW Group Report 2024 Page 276 Page 278

BMW Group Report 2024 Page 276 Page 278