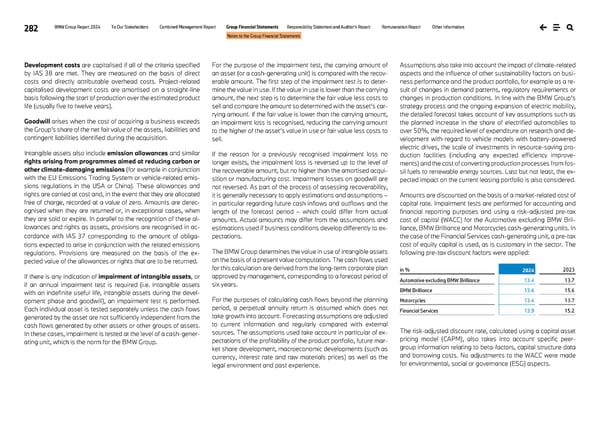

282 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Notes to the Group Financial Statements Development costs are capitalised if all of the criteria specified by IAS 38 are met. They are measured on the basis of direct costs and directly attributable overhead costs. Project-related capitalised development costs are amortised on a straight-line basis following the start of production over the estimated product life (usually five to twelve years). Goodwill arises when the cost of acquiring a business exceeds the Group’s share of the net fair value of the assets, liabilities and contingent liabilities identified during the acquisition. Intangible assets also include emission allowances and similar rights arising from programmes aimed at reducing carbon or other climate-damaging emissions (for example in conjunction with the EU Emissions Trading System or vehicle-related emis- sions regulations in the USA or China). These allowances and rights are carried at cost and, in the event that they are allocated free of charge, recorded at a value of zero. Amounts are derec- ognised when they are returned or, in exceptional cases, when they are sold or expire. In parallel to the recognition of these al- lowances and rights as assets, provisions are recognised in ac- cordance with IAS 37 corresponding to the amount of obliga- tions expected to arise in conjunction with the related emissions regulations. Provisions are measured on the basis of the ex- pected value of the allowances or rights that are to be returned. If there is any indication of impairment of intangible assets, or if an annual impairment test is required (i.e. intangible assets with an indefinite useful life, intangible assets during the devel- opment phase and goodwill), an impairment test is performed. Each individual asset is tested separately unless the cash flows generated by the asset are not sufficiently independent from the cash flows generated by other assets or other groups of assets. In these cases, impairment is tested at the level of a cash-gener- ating unit, which is the norm for the BMW Group. For the purpose of the impairment test, the carrying amount of an asset (or a cash-generating unit) is compared with the recov- erable amount. The first step of the impairment test is to deter- mine the value in use. If the value in use is lower than the carrying amount, the next step is to determine the fair value less costs to sell and compare the amount so determined with the asset’s car- rying amount. If the fair value is lower than the carrying amount, an impairment loss is recognised, reducing the carrying amount to the higher of the asset’s value in use or fair value less costs to sell. If the reason for a previously recognised impairment loss no longer exists, the impairment loss is reversed up to the level of the recoverable amount, but no higher than the amortised acqui- sition or manufacturing cost. Impairment losses on goodwill are not reversed. As part of the process of assessing recoverability, it is generally necessary to apply estimations and assumptions – in particular regarding future cash inflows and outflows and the length of the forecast period – which could differ from actual amounts. Actual amounts may differ from the assumptions and estimations used if business conditions develop differently to ex- pectations. The BMW Group determines the value in use of intangible assets on the basis of a present value computation. The cash flows used for this calculation are derived from the long-term corporate plan approved by management, corresponding to a forecast period of six years. For the purposes of calculating cash flows beyond the planning period, a perpetual annuity return is assumed which does not take growth into account. Forecasting assumptions are adjusted to current information and regularly compared with external sources. The assumptions used take account in particular of ex- pectations of the profitability of the product portfolio, future mar- ket share development, macroeconomic developments (such as currency, interest rate and raw materials prices) as well as the legal environment and past experience. Assumptions also take into account the impact of climate-related aspects and the influence of other sustainability factors on busi- ness performance and the product portfolio, for example as a re- sult of changes in demand patterns, regulatory requirements or changes in production conditions. In line with the BMW Group’s strategy process and the ongoing expansion of electric mobility, the detailed forecast takes account of key assumptions such as the planned increase in the share of electrified automobiles to over 50%, the required level of expenditure on research and de- velopment with regard to vehicle models with battery-powered electric drives, the scale of investments in resource-saving pro- duction facilities (including any expected efficiency improve- ments) and the cost of converting production processes from fos- sil fuels to renewable energy sources. Last but not least, the ex- pected impact on the current leasing portfolio is also considered. Amounts are discounted on the basis of a market-related cost of capital rate. Impairment tests are performed for accounting and financial reporting purposes and using a risk-adjusted pre-tax cost of capital (WACC) for the Automotive excluding BMW Bril- liance, BMW Brilliance and Motorcycles cash-generating units. In the case of the Financial Services cash-generating unit, a pre-tax cost of equity capital is used, as is customary in the sector. The following pre-tax discount factors were applied: in % 2024 2023 Automotive excluding BMW Brilliance 13.4 13.7 BMW Brilliance 13.6 15.6 Motorcycles 13.4 13.7 Financial Services 13.9 15.2 The risk-adjusted discount rate, calculated using a capital asset pricing model (CAPM), also takes into account specific peer- group information relating to beta-factors, capital structure data and borrowing costs. No adjustments to the WACC were made for environmental, social or governance (ESG) aspects.

BMW Group Report 2024 Page 281 Page 283

BMW Group Report 2024 Page 281 Page 283