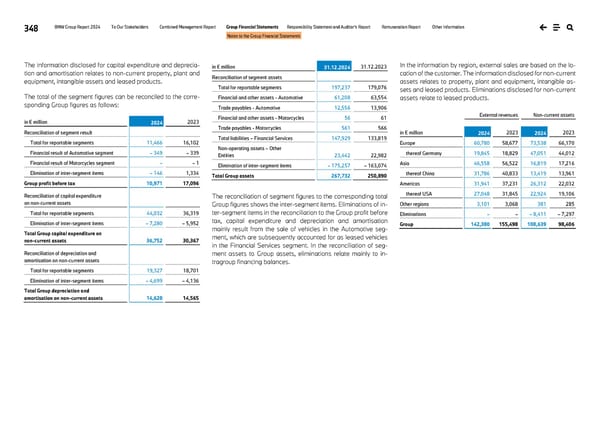

348 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Notes to the Group Financial Statements The information disclosed for capital expenditure and deprecia- tion and amortisation relates to non-current property, plant and equipment, intangible assets and leased products. The total of the segment figures can be reconciled to the corre- sponding Group figures as follows: in € million 2024 2023 Reconciliation of segment result Total for reportable segments 11,466 16,102 Financial result of Automotive segment – 349 – 339 Financial result of Motorcycles segment – – 1 Elimination of inter-segment items – 146 1,334 Group profit before tax 10,971 17,096 Reconciliation of capital expenditure on non-current assets Total for reportable segments 44,032 36,319 Elimination of inter-segment items – 7,280 – 5,952 Total Group capital expenditure on non-current assets 36,752 30,367 Reconciliation of depreciation and amortisation on non-current assets Total for reportable segments 19,327 18,701 Elimination of inter-segment items – 4,699 – 4,136 Total Group depreciation and amortisation on non-current assets 14,628 14,565 in € million 31.12.2024 31.12.2023 Reconciliation of segment assets Total for reportable segments 197,237 179,076 Financial and other assets - Automotive 61,208 63,554 Trade payables - Automotive 12,556 13,906 Financial and other assets - Motorcycles 56 61 Trade payables - Motorcycles 561 566 Total liabilities – Financial Services 147,929 133,819 Non-operating assets – Other Entities 23,442 22,982 Elimination of inter-segment items – 175,257 – 163,074 Total Group assets 267,732 250,890 The reconciliation of segment figures to the corresponding total Group figures shows the inter-segment items. Eliminations of in- ter-segment items in the reconciliation to the Group profit before tax, capital expenditure and depreciation and amortisation mainly result from the sale of vehicles in the Automotive seg- ment, which are subsequently accounted for as leased vehicles in the Financial Services segment. In the reconciliation of seg- ment assets to Group assets, eliminations relate mainly to in- tragroup financing balances. In the information by region, external sales are based on the lo- cation of the customer. The information disclosed for non-current assets relates to property, plant and equipment, intangible as- sets and leased products. Eliminations disclosed for non-current assets relate to leased products. External revenues Non-current assets in € million 2024 2023 2024 2023 Europe 60,780 58,677 73,538 66,170 thereof Germany 19,845 18,829 47,051 44,012 Asia 46,558 56,522 16,819 17,216 thereof China 31,786 40,833 13,419 13,961 Americas 31,941 37,231 26,312 22,032 thereof USA 27,048 31,845 22,924 19,106 Other regions 3,101 3,068 381 285 Eliminations – – – 8,411 – 7,297 Group 142,380 155,498 108,639 98,406

BMW Group Report 2024 Page 347 Page 349

BMW Group Report 2024 Page 347 Page 349