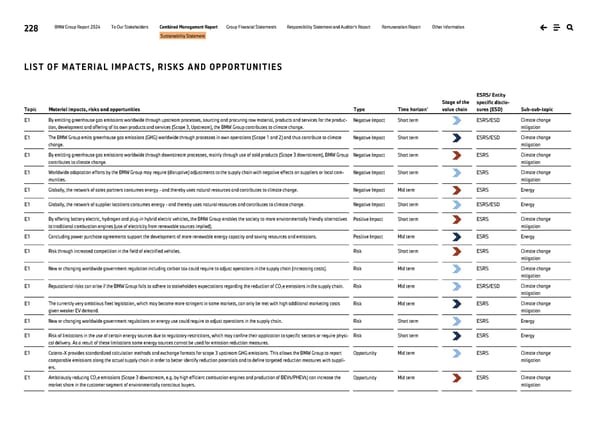

228 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Sustainability Statement LIST OF MATERIAL IMPACTS, RISKS AND OPPORTUNITIES Topic Material impacts, risks and opportunities Type Time horizon* Stage of the value chain ESRS/ Entity specific disclo- sures (ESD) Sub-sub-topic E1 By emitting greenhouse gas emissions worldwide through upstream processes, sourcing and procuring raw material, products and services for the produc- tion, development and offering of its own products and services (Scope 3, Upstream), the BMW Group contributes to climate change. Negative Impact Short term ESRS/ESD Climate change mitigation E1 The BMW Group emits greenhouse gas emissions (GHG) worldwide through processes in own operations (Scope 1 and 2) and thus contribute to climate change. Negative Impact Short term ESRS/ESD Climate change mitigation E1 By emitting greenhouse gas emissions worldwide through downstream processes, mainly through use of sold products (Scope 3 downstream), BMW Group contributes to climate change. Negative Impact Short term ESRS Climate change mitigation E1 Worldwide adaptation efforts by the BMW Group may require (disruptive) adjustments to the supply chain with negative effects on suppliers or local com- munities. Negative Impact Short term ESRS Climate change mitigation E1 Globally, the network of sales partners consumes energy - and thereby uses natural resources and contributes to climate change. Negative Impact Mid term ESRS Energy E1 Globally, the network of supplier locations consumes energy - and thereby uses natural resources and contributes to climate change. Negative Impact Short term ESRS/ESD Energy E1 By offering battery electric, hydrogen and plug-in hybrid electric vehicles, the BMW Group enables the society to more environmentally friendly alternatives to traditional combustion engines (use of electricity from renewable sources implied). Positive Impact Short term ESRS Climate change mitigation E1 Concluding power purchase agreements support the development of more renewable energy capacity and saving resources and emissions. Positive Impact Mid term ESRS Energy E1 Risk through increased competition in the field of electrified vehicles. Risk Short term ESRS Climate change mitigation E1 New or changing worldwide government regulation including carbon tax could require to adjust operations in the supply chain (increasing costs). Risk Mid term ESRS Climate change mitigation E1 Reputational risks can arise if the BMW Group fails to adhere to stakeholders expectations regarding the reduction of CO2e emissions in the supply chain. Risk Mid term ESRS/ESD Climate change mitigation E1 The currently very ambitious fleet legislation, which may become more stringent in some markets, can only be met with high additional marketing costs given weaker EV demand. Risk Mid term ESRS Climate change mitigation E1 New or changing worldwide government regulations on energy use could require to adjust operations in the supply chain. Risk Short term ESRS Energy E1 Risk of limitations in the use of certain energy sources due to regulatory restrictions, which may confine their application to specific sectors or require physi- cal delivery. As a result of these limitations some energy sources cannot be used for emission reduction measures. Risk Short term ESRS Energy E1 Catena-X provides standardized calculation methods and exchange formats for scope 3 upstream GHG emissions. This allows the BMW Group to report comparable emissions along the actual supply chain in order to better identify reduction potentials and to define targeted reduction measures with suppli- ers. Opportunity Mid term ESRS Climate change mitigation E1 Ambitiously reducing CO2e emissions (Scope 3 downstream, e.g. by high efficient combustion engines and production of BEVs/PHEVs) can increase the market share in the customer segment of environmentally conscious buyers. Opportunity Mid term ESRS Climate change mitigation

BMW Group Report 2024 Page 227 Page 229

BMW Group Report 2024 Page 227 Page 229