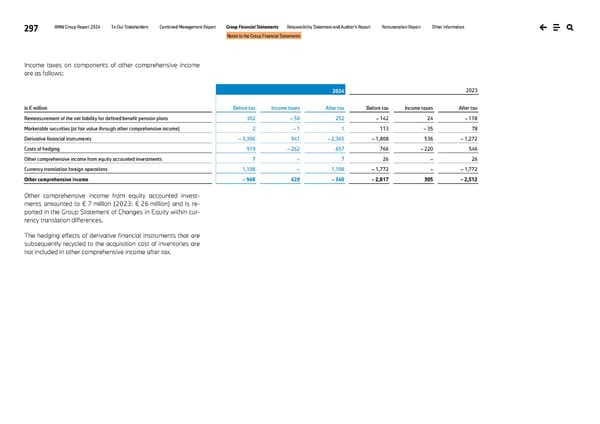

297 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Notes to the Group Financial Statements Income taxes on components of other comprehensive income are as follows: 2024 2023 in € million Before tax Income taxes After tax Before tax Income taxes After tax Remeasurement of the net liability for defined benefit pension plans 302 – 50 252 – 142 24 – 118 Marketable securities (at fair value through other comprehensive income) 2 – 1 1 113 – 35 78 Derivative financial instruments – 3,306 941 – 2,365 – 1,808 536 – 1,272 Costs of hedging 919 – 262 657 766 – 220 546 Other comprehensive income from equity accounted investments 7 – 7 26 – 26 Currency translation foreign operations 1,108 – 1,108 – 1,772 – – 1,772 Other comprehensive income – 968 628 – 340 – 2,817 305 – 2,512 Other comprehensive income from equity accounted invest- ments amounted to € 7 million (2023: € 26 million) and is re- ported in the Group Statement of Changes in Equity within cur- rency translation differences. The hedging effects of derivative financial instruments that are subsequently recycled to the acquisition cost of inventories are not included in other comprehensive income after tax.

BMW Group Report 2024 Page 296 Page 298

BMW Group Report 2024 Page 296 Page 298