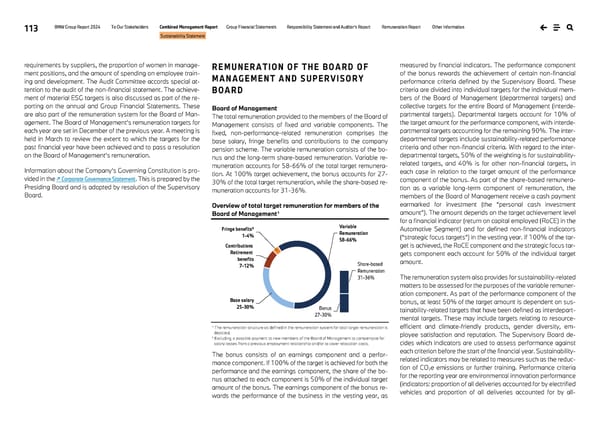

113 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Sustainability Statement requirements by suppliers, the proportion of women in manage- ment positions, and the amount of spending on employee train- ing and development. The Audit Committee accords special at- tention to the audit of the non-financial statement. The achieve- ment of material ESG targets is also discussed as part of the re- porting on the annual and Group Financial Statements. These are also part of the remuneration system for the Board of Man- agement. The Board of Management’s remuneration targets for each year are set in December of the previous year. A meeting is held in March to review the extent to which the targets for the past financial year have been achieved and to pass a resolution on the Board of Management’s remuneration. Information about the Company’s Governing Constitution is pro- vided in the ↗ Corporate Governance Statement. This is prepared by the Presiding Board and is adopted by resolution of the Supervisory Board. REMUNERATION OF THE BOARD OF MANAGEMENT AND SUPERVISORY BOARD Board of Management The total remuneration provided to the members of the Board of Management consists of fixed and variable components. The fixed, non-performance-related remuneration comprises the base salary, fringe benefits and contributions to the company pension scheme. The variable remuneration consists of the bo- nus and the long-term share-based remuneration. Variable re- muneration accounts for 58-66% of the total target remunera- tion. At 100% target achievement, the bonus accounts for 27- 30% of the total target remuneration, while the share-based re- muneration accounts for 31-36%. Overview of total target remuneration for members of the Board of Management1 1 The remuneration structure as defined in the remuneration system for total target remuneration is depicted. 2 Excluding a possible payment to new members of the Board of Management to compensate for salary losses from a previous employment relationship and/or to cover relocation costs. The bonus consists of an earnings component and a perfor- mance component. If 100% of the target is achieved for both the performance and the earnings component, the share of the bo- nus attached to each component is 50% of the individual target amount of the bonus. The earnings component of the bonus re- wards the performance of the business in the vesting year, as measured by financial indicators. The performance component of the bonus rewards the achievement of certain non-financial performance criteria defined by the Supervisory Board. These criteria are divided into individual targets for the individual mem- bers of the Board of Management (departmental targets) and collective targets for the entire Board of Management (interde- partmental targets). Departmental targets account for 10% of the target amount for the performance component, with interde- partmental targets accounting for the remaining 90%. The inter- departmental targets include sustainability-related performance criteria and other non-financial criteria. With regard to the inter- departmental targets, 50% of the weighting is for sustainability- related targets, and 40% is for other non-financial targets, in each case in relation to the target amount of the performance component of the bonus. As part of the share-based remunera- tion as a variable long-term component of remuneration, the members of the Board of Management receive a cash payment earmarked for investment (the “personal cash investment amount”). The amount depends on the target achievement level for a financial indicator (return on capital employed (RoCE) in the Automotive Segment) and for defined non-financial indicators (“strategic focus targets”) in the vesting year. If 100% of the tar- get is achieved, the RoCE component and the strategic focus tar- gets component each account for 50% of the individual target amount. The remuneration system also provides for sustainability-related matters to be assessed for the purposes of the variable remuner- ation component. As part of the performance component of the bonus, at least 50% of the target amount is dependent on sus- tainability-related targets that have been defined as interdepart- mental targets. These may include targets relating to resource- efficient and climate-friendly products, gender diversity, em- ployee satisfaction and reputation. The Supervisory Board de- cides which indicators are used to assess performance against each criterion before the start of the financial year. Sustainability- related indicators may be related to measures such as the reduc- tion of CO2e emissions or further training. Performance criteria for the reporting year are environmental innovation performance (indicators: proportion of all deliveries accounted for by electrified vehicles and proportion of all deliveries accounted for by all- Variable Remuneration 58-66% Base salary 25-30% Contributions Retirement benefits 7-12% Fringe benefits² 1-4% Bonus 27-30% Share-based Remuneration 31-36%

BMW Group Report 2024 Page 112 Page 114

BMW Group Report 2024 Page 112 Page 114