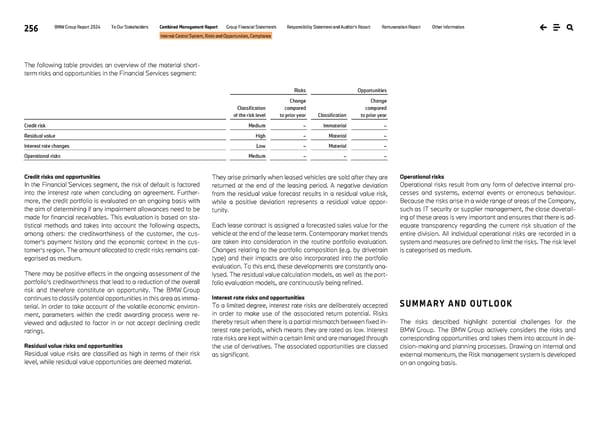

256 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Internal Control System, Risks and Opportunities, Compliance The following table provides an overview of the material short- term risks and opportunities in the Financial Services segment: Credit risks and opportunities In the Financial Services segment, the risk of default is factored into the interest rate when concluding an agreement. Further- more, the credit portfolio is evaluated on an ongoing basis with the aim of determining if any impairment allowances need to be made for financial receivables. This evaluation is based on sta- tistical methods and takes into account the following aspects, among others: the creditworthiness of the customer, the cus- tomer’s payment history and the economic context in the cus- tomer’s region. The amount allocated to credit risks remains cat- egorised as medium. There may be positive effects in the ongoing assessment of the portfolio’s creditworthiness that lead to a reduction of the overall risk and therefore constitute an opportunity. The BMW Group continues to classify potential opportunities in this area as imma- terial. In order to take account of the volatile economic environ- ment, parameters within the credit awarding process were re- viewed and adjusted to factor in or not accept declining credit ratings. Residual value risks and opportunities Residual value risks are classified as high in terms of their risk level, while residual value opportunities are deemed material. They arise primarily when leased vehicles are sold after they are returned at the end of the leasing period. A negative deviation from the residual value forecast results in a residual value risk, while a positive deviation represents a residual value oppor- tunity. Each lease contract is assigned a forecasted sales value for the vehicle at the end of the lease term. Contemporary market trends are taken into consideration in the routine portfolio evaluation. Changes relating to the portfolio composition (e.g. by drivetrain type) and their impacts are also incorporated into the portfolio evaluation. To this end, these developments are constantly ana- lysed. The residual value calculation models, as well as the port- folio evaluation models, are continuously being refined. Interest rate risks and opportunities To a limited degree, interest rate risks are deliberately accepted in order to make use of the associated return potential. Risks thereby result when there is a partial mismatch between fixed in- terest rate periods, which means they are rated as low. Interest rate risks are kept within a certain limit and are managed through the use of derivatives. The associated opportunities are classed as significant. Operational risks Operational risks result from any form of defective internal pro- cesses and systems, external events or erroneous behaviour. Because the risks arise in a wide range of areas of the Company, such as IT security or supplier management, the close dovetail- ing of these areas is very important and ensures that there is ad- equate transparency regarding the current risk situation of the entire division. All individual operational risks are recorded in a system and measures are defined to limit the risks. The risk level is categorised as medium. SUMMARY AND OUTLOOK The risks described highlight potential challenges for the BMW Group. The BMW Group actively considers the risks and corresponding opportunities and takes them into account in de- cision-making and planning processes. Drawing on internal and external momentum, the Risk management system is developed on an ongoing basis. Risks Opportunities Classification of the risk level Change compared to prior year Classification Change compared to prior year Credit risk Medium – Immaterial – Residual value High – Material – Interest rate changes Low – Material – Operational risks Medium – – –

BMW Group Report 2024 Page 255 Page 257

BMW Group Report 2024 Page 255 Page 257