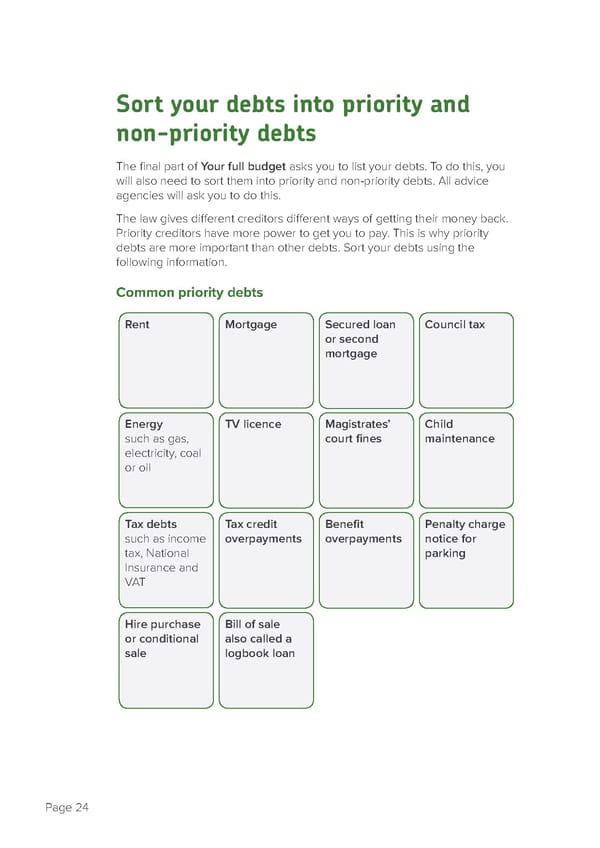

Sort your debts into priority and non-priority debts The final part of Your full budget asks you to list your debts. To do this, you will also need to sort them into priority and non-priority debts. All advice agencies will ask you to do this. The law gives different creditors different ways of getting their money back. Priority creditors have more power to get you to pay. This is why priority debts are more important than other debts. Sort your debts using the following information. Common priority debts Rent Mortgage Secured loan Council tax or second mortgage Energy TV licence Magistrates’ Child such as gas, court fines maintenance electricity, coal or oil Tax debts Tax credit Benefit Penalty charge such as income overpayments overpayments notice for tax, National parking Insurance and VAT Hire purchase Bill of sale or conditional also called a sale logbook loan Page 24

how-to-deal-with-debt Page 25 Page 27

how-to-deal-with-debt Page 25 Page 27