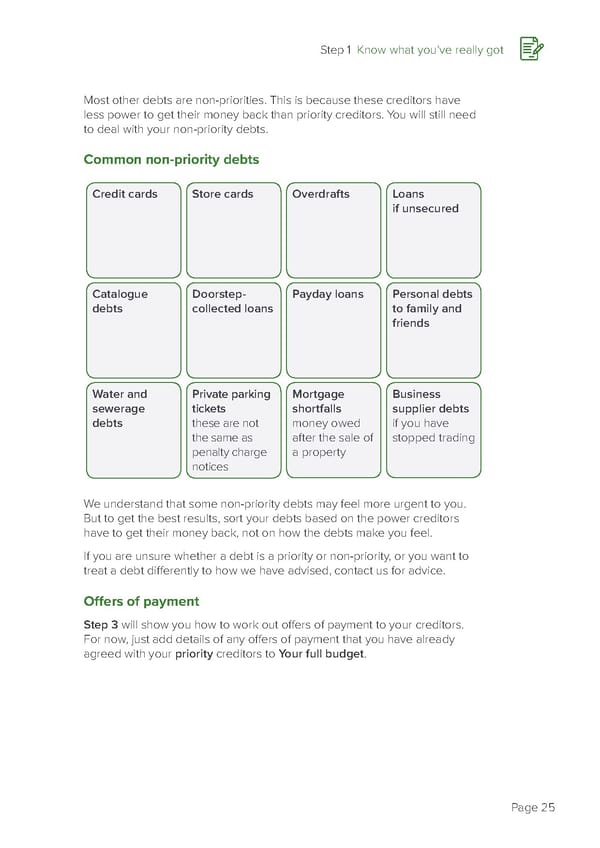

Step 1 Know what you’ve really got 1 Most other debts are non-priorities. This is because these creditors have less power to get their money back than priority creditors. You will still need to deal with your non-priority debts. Common non-priority debts Credit cards Store cards Overdrafts Loans if unsecured Catalogue Doorstep- Payday loans Personal debts debts collected loans to family and friends Water and Private parking Mortgage Business sewerage tickets shortfalls supplier debts debts these are not money owed if you have the same as after the sale of stopped trading penalty charge a property notices We understand that some non-priority debts may feel more urgent to you. But to get the best results, sort your debts based on the power creditors have to get their money back, not on how the debts make you feel. If you are unsure whether a debt is a priority or non-priority, or you want to treat a debt differently to how we have advised, contact us for advice. Offers of payment Step 3 will show you how to work out offers of payment to your creditors. For now, just add details of any offers of payment that you have already agreed with your priority creditors to Your full budget. Page 25

how-to-deal-with-debt Page 26 Page 28

how-to-deal-with-debt Page 26 Page 28