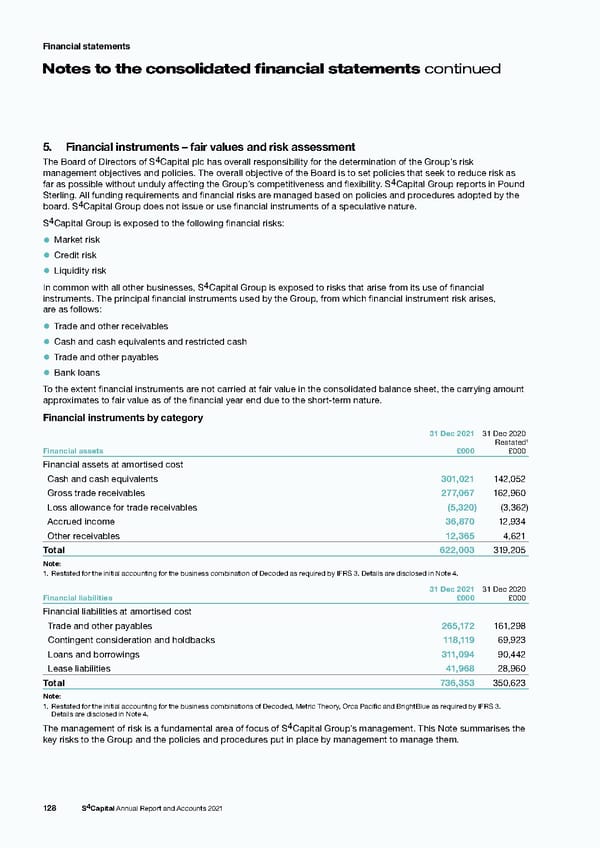

Financial statements N otes to the consolidated financial statements continued 5. Financial instruments – fair values and risk assessment The Board of Directors of S4Capital plc has overall responsibility for the determination of the Group’s risk management objectives and policies. The overall objective of the Board is to set policies that seek to reduce risk as far as possible without unduly affecting the Group’s competitiveness and flexibility. S4Capital Group reports in Pound Sterling. All funding requirements and financial risks are managed based on policies and procedures adopted by the board. S4Capital Group does not issue or use financial instruments of a speculative nature. S4Capital Group is exposed to the following financial risks: • Market risk • Credit risk • Liquidity risk In common with all other businesses, S4Capital Group is exposed to risks that arise from its use of financial instruments. The principal financial instruments used by the Group, from which financial instrument risk arises, are as follows: • Trade and other receivables • Cash and cash equivalents and restricted cash • Trade and other payables • Bank loans To the extent financial instruments are not carried at fair value in the consolidated balance sheet, the carrying amount approximates to fair value as of the financial year end due to the short-term nature. Financial instruments by category 31 Dec 2021 31 Dec 2020 1 Restated Financial assets £000 £000 Financial assets at amortised cost Cash and cash equivalents 301,021 142,052 Gross trade receivables 277,067 162,960 Loss allowance for trade receivables (5,320) (3,362) Accrued income 36,870 12,934 Other receivables 12,365 4,621 Total 622,003 319,205 Note: 1. Restated for the initial accounting for the business combination of Decoded as required by IFRS 3. Details are disclosed in Note 4. 31 Dec 2021 31 Dec 2020 Financial liabilities £000 £000 Financial liabilities at amortised cost Trade and other payables 265,172 161,298 Contingent consideration and holdbacks 118,119 69,923 Loans and borrowings 311,094 90,442 Lease liabilities 41,968 28,960 Total 736,353 350,623 Note: 1. Restated for the initial accounting for the business combinations of Decoded, Metric Theory, Orca Pacific and BrightBlue as required by IFRS 3. Details are disclosed in Note 4. The management of risk is a fundamental area of focus of S4Capital Group’s management. This Note summarises the key risks to the Group and the policies and procedures put in place by management to manage them. 128 S4Capital Annual Report and Accounts 2021

s4 capital annual report and accounts 2021 Page 129 Page 131

s4 capital annual report and accounts 2021 Page 129 Page 131