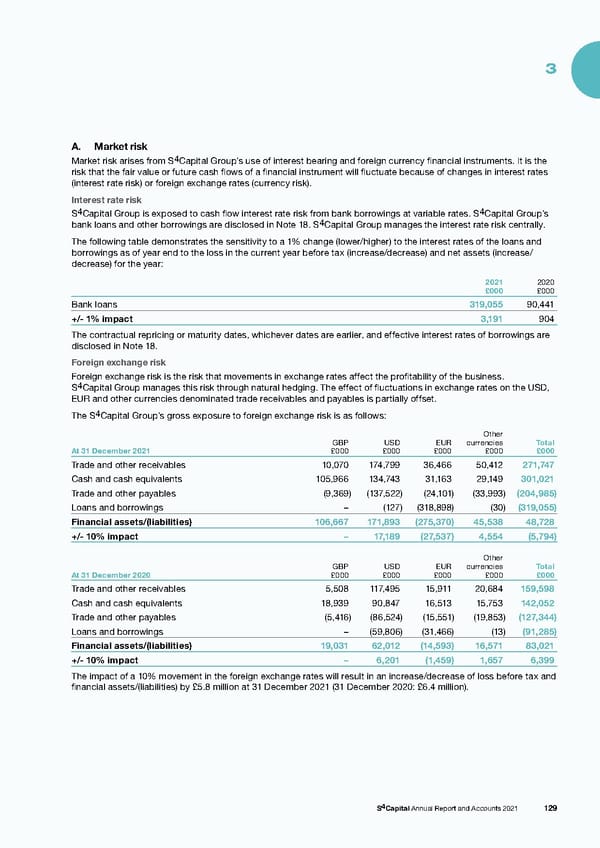

3 A. Market risk Market risk arises from S4Capital Group’s use of interest bearing and foreign currency financial instruments. It is the risk that the fair value or future cash flows of a financial instrument will fluctuate because of changes in interest rates (interest rate risk) or foreign exchange rates (currency risk). Interest rate risk S4Capital Group is exposed to cash flow interest rate risk from bank borrowings at variable rates. S4Capital Group’s bank loans and other borrowings are disclosed in Note 18. S4Capital Group manages the interest rate risk centrally. The following table demonstrates the sensitivity to a 1% change (lower/higher) to the interest rates of the loans and borrowings as of year end to the loss in the current year before tax (increase/decrease) and net assets (increase/ decrease) for the year: 2021 2020 £000 £000 Bank loans 319,055 90,441 +/- 1% impact 3,191 904 The contractual repricing or maturity dates, whichever dates are earlier, and effective interest rates of borrowings are disclosed in Note 18. Foreign exchange risk Foreign exchange risk is the risk that movements in exchange rates affect the profitability of the business. S4Capital Group manages this risk through natural hedging. The effect of fluctuations in exchange rates on the USD, EUR and other currencies denominated trade receivables and payables is partially offset. The S4Capital Group’s gross exposure to foreign exchange risk is as follows: Other GBP USD EUR currencies Total At 31 December 2021 £000 £000 £000 £000 £000 Trade and other receivables 10,070 174,799 36,466 50,412 271,747 Cash and cash equivalents 105,966 134,743 31,163 29,149 301,021 Trade and other payables (9,369) ( 137,522) ( 24,101) (33,993) (204,985) Loans and borrowings – (127) (318,898) (30) (319,055) Financial assets/(liabilities) 106,667 171,893 (275,370) 45,538 48,728 +/- 10% impact – 17,189 (27,537) 4,554 (5,794) Other GBP USD EUR currencies Total At 31 December 2020 £000 £000 £000 £000 £000 Trade and other receivables 5,508 117,495 15,911 20,684 159,598 Cash and cash equivalents 18,939 90,847 16,513 15,753 142,052 Trade and other payables (5,416) (86,524) (15,551) (19,853) (127,344) Loans and borrowings – (59,806) (31,466) (13) (91,285) Financial assets/(liabilities) 19,031 62,012 (14,593) 16,571 83,021 +/- 10% impact – 6,201 (1,459) 1,657 6,399 The impact of a 10% movement in the foreign exchange rates will result in an increase/decrease of loss before tax and financial assets/(liabilities) by £5.8 million at 31 December 2021 (31 December 2020: £6.4 million). S4Capital Annual Report and Accounts 2021 129

s4 capital annual report and accounts 2021 Page 130 Page 132

s4 capital annual report and accounts 2021 Page 130 Page 132