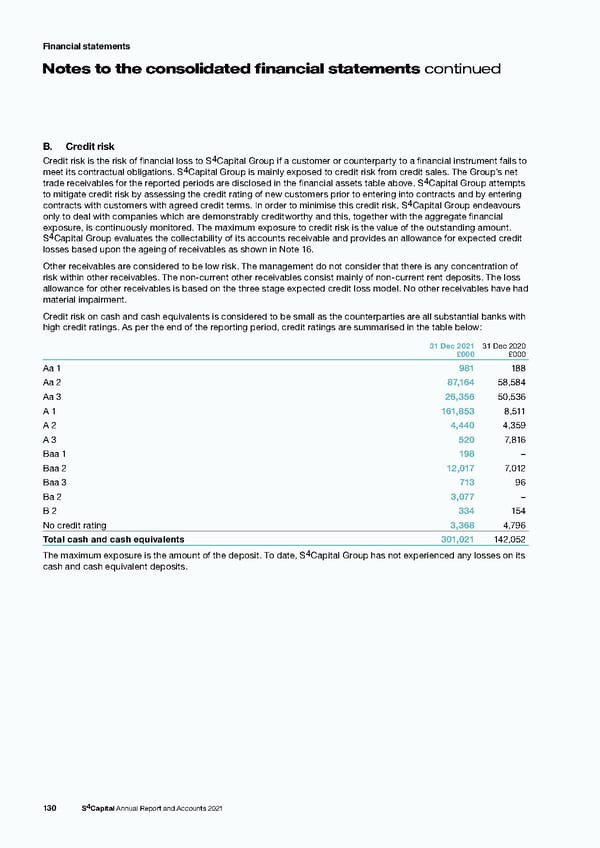

Financial statements N otes to the consolidated financial statements continued B. Credit risk Credit risk is the risk of financial loss to S4Capital Group if a customer or counterparty to a financial instrument fails to meet its contractual obligations. S4Capital Group is mainly exposed to credit risk from credit sales. The Group’s net trade receivables for the reported periods are disclosed in the financial assets table above. S4Capital Group attempts to mitigate credit risk by assessing the credit rating of new customers prior to entering into contracts and by entering contracts with customers with agreed credit terms. In order to minimise this credit risk, S4Capital Group endeavours only to deal with companies which are demonstrably creditworthy and this, together with the aggregate financial exposure, is continuously monitored. The maximum exposure to credit risk is the value of the outstanding amount. S4Capital Group evaluates the collectability of its accounts receivable and provides an allowance for expected credit losses based upon the ageing of receivables as shown in Note 16. Other receivables are considered to be low risk. The management do not consider that there is any concentration of risk within other receivables. The non-current other receivables consist mainly of non-current rent deposits. The loss allowance for other receivables is based on the three stage expected credit loss model. No other receivables have had material impairment. Credit risk on cash and cash equivalents is considered to be small as the counterparties are all substantial banks with high credit ratings. As per the end of the reporting period, credit ratings are summarised in the table below: 31 Dec 2021 31 Dec 2020 £000 £000 Aa 1 981 188 Aa 2 87,164 58,584 Aa 3 26,356 50,536 A 1 161,853 8,511 A 2 4,440 4,359 A 3 520 7,816 Baa 1 198 – Baa 2 12,017 7,012 Baa 3 713 96 Ba 2 3,077 – B 2 334 154 No credit rating 3,368 4,796 Total cash and cash equivalents 301,021 142,052 The maximum exposure is the amount of the deposit. To date, S4Capital Group has not experienced any losses on its cash and cash equivalent deposits. 130 S4Capital Annual Report and Accounts 2021

s4 capital annual report and accounts 2021 Page 131 Page 133

s4 capital annual report and accounts 2021 Page 131 Page 133