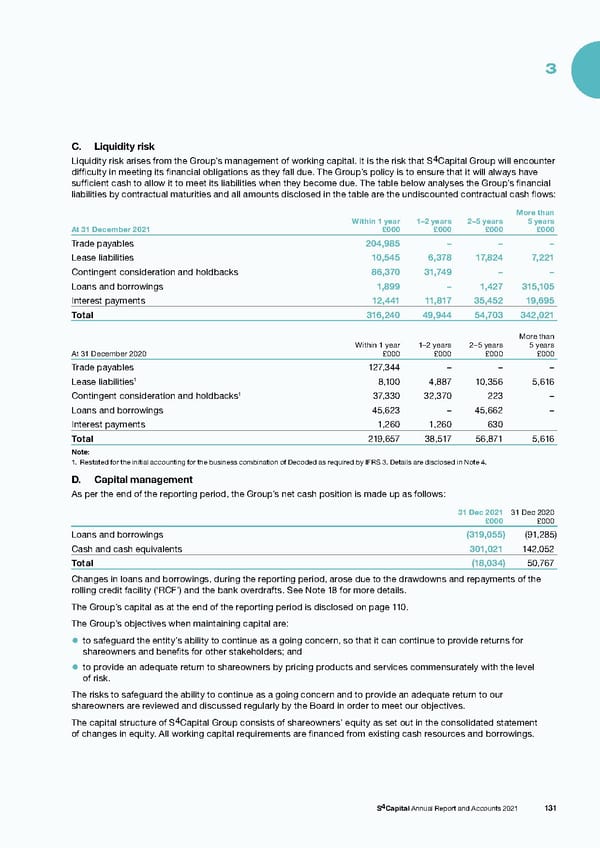

3 C. Liquidity risk Liquidity risk arises from the Group’s management of working capital. It is the risk that S4Capital Group will encounter difficulty in meeting its financial obligations as they fall due. The Group’s policy is to ensure that it will always have sufficient cash to allow it to meet its liabilities when they become due. The table below analyses the Group’s financial liabilities by contractual maturities and all amounts disclosed in the table are the undiscounted contractual cash flows: More than Within 1 year 1–2 years 2–5 years 5 years At 31 December 2021 £000 £000 £000 £000 Trade payables 204,985 – – – Lease liabilities 10,545 6,378 17,824 7,221 Contingent consideration and holdbacks 86,370 31,749 – – Loans and borrowings 1,899 – 1,427 315,105 Interest payments 12,441 11,817 35,452 19,695 Total 316,240 49,944 54,703 342,021 More than Within 1 year 1–2 years 2–5 years 5 years At 31 December 2020 £000 £000 £000 £000 Trade payables 127,344 – – – 1 8,100 4,887 10,356 5,616 Lease liabilities 1 Contingent consideration and holdbacks 37,330 32,370 223 – Loans and borrowings 45,623 – 45,662 – Interest payments 1,260 1,260 630 Total 219,657 38,517 56,871 5,616 Note: 1. Restated for the initial accounting for the business combination of Decoded as required by IFRS 3. Details are disclosed in Note 4. D. Capital management As per the end of the reporting period, the Group’s net cash position is made up as follows: 31 Dec 2021 31 Dec 2020 £000 £000 Loans and borrowings (319,055) (91,285) Cash and cash equivalents 301,021 142,052 Total (18,034) 50,767 Changes in loans and borrowings, during the reporting period, arose due to the drawdowns and repayments of the rolling credit facility (‘RCF’) and the bank overdrafts. See Note 18 for more details. The Group’s capital as at the end of the reporting period is disclosed on page 110. The Group’s objectives when maintaining capital are: • to safeguard the entity’s ability to continue as a going concern, so that it can continue to provide returns for shareowners and benefits for other stakeholders; and • to provide an adequate return to shareowners by pricing products and services commensurately with the level of risk. The risks to safeguard the ability to continue as a going concern and to provide an adequate return to our shareowners are reviewed and discussed regularly by the Board in order to meet our objectives. The capital structure of S4Capital Group consists of shareowners’ equity as set out in the consolidated statement of changes in equity. All working capital requirements are financed from existing cash resources and borrowings. S4Capital Annual Report and Accounts 2021 131

s4 capital annual report and accounts 2021 Page 132 Page 134

s4 capital annual report and accounts 2021 Page 132 Page 134