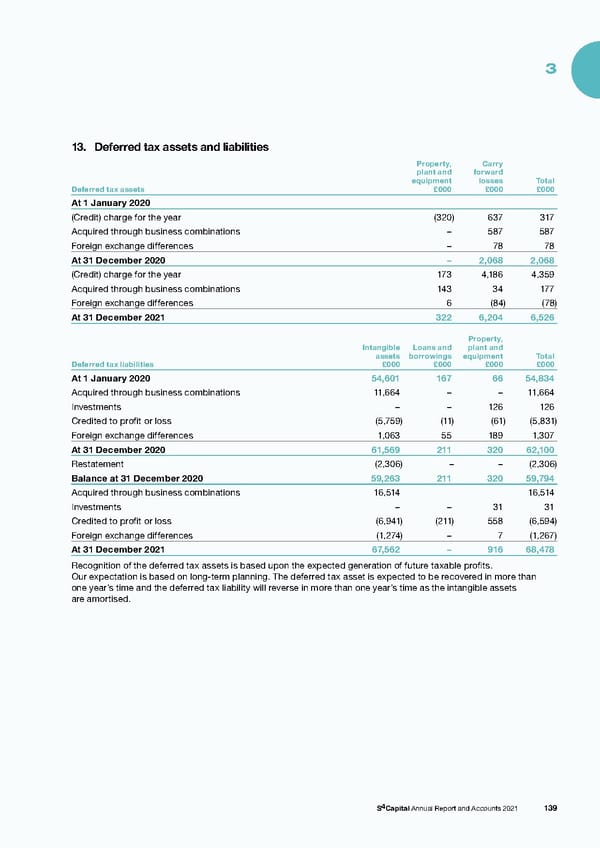

3 13. Deferred tax assets and liabilities Property, Carry plant and forward equipment losses Total Deferred tax assets £000 £000 £000 At 1 January 2020 (Credit) charge for the year (320) 637 317 Acquired through business combinations – 587 587 Foreign exchange differences – 78 78 At 31 December 2020 – 2,068 2,068 (Credit) charge for the year 173 4,186 4,359 Acquired through business combinations 143 34 177 Foreign exchange differences 6 (84) (78) At 31 December 2021 322 6,204 6,526 Property, Intangible Loans and plant and assets borrowings equipment Total Deferred tax liabilities £000 £000 £000 £000 At 1 January 2020 54,601 167 66 54,834 Acquired through business combinations 11,664 – – 11,664 Investments – – 126 126 Credited to profit or loss (5,759) (11) (61) (5,831) Foreign exchange differences 1,063 55 189 1,307 At 31 December 2020 61,569 211 320 62,100 Restatement (2,306) – – (2,306) Balance at 31 December 2020 59,263 211 320 59,794 Acquired through business combinations 16,514 16,514 Investments – – 31 31 Credited to profit or loss (6,941) ( 211) 558 (6,594) Foreign exchange differences (1,274) – 7 (1,267) At 31 December 2021 67,562 – 916 68,478 Recognition of the deferred tax assets is based upon the expected generation of future taxable profits. Our expectation is based on long-term planning. The deferred tax asset is expected to be recovered in more than one year’s time and the deferred tax liability will reverse in more than one year’s time as the intangible assets are amortised. S4Capital Annual Report and Accounts 2021 139

s4 capital annual report and accounts 2021 Page 140 Page 142

s4 capital annual report and accounts 2021 Page 140 Page 142