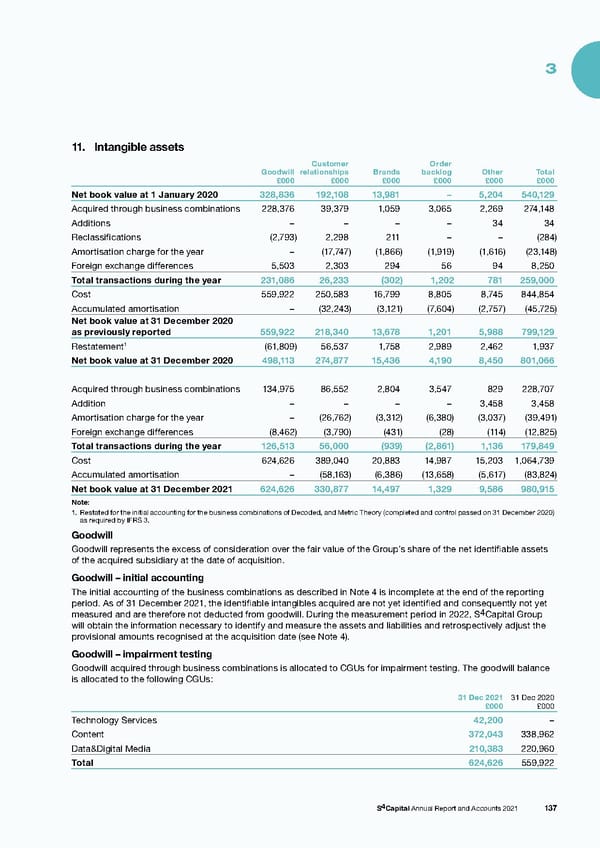

3 11. Intangible assets Customer Order Goodwill relationships Brands backlog Other Total £000 £000 £000 £000 £000 £000 Net book value at 1 January 2020 328,836 192,108 13,981 – 5,204 540,129 Acquired through business combinations 228,376 39,379 1,059 3,065 2,269 274,148 Additions – – – – 34 34 Reclassifications (2,793) 2,298 211 – – (284) Amortisation charge for the year – ( 17,747) (1,866) (1,919) (1,616) ( 23,148) Foreign exchange differences 5,503 2,303 294 56 94 8,250 Total transactions during the year 231,086 26,233 (302) 1,202 781 259,000 Cost 559,922 250,583 16,799 8,805 8,745 844,854 Accumulated amortisation – (32,243) ( 3,121) ( 7,604) (2,757) (45,725) Net book value at 31 December 2020 as previously reported 559,922 218,340 13,678 1,201 5,988 799,129 1 (61,809) 56,537 1,758 2,989 2,462 1,937 Restatement Net book value at 31 December 2020 498,113 274,877 15,436 4,190 8,450 801,066 Acquired through business combinations 134,975 86,552 2,804 3,547 829 228,707 Addition – – – – 3,458 3,458 Amortisation charge for the year – (26,762) (3,312) (6,380) (3,037) (39,491) Foreign exchange differences (8,462) (3,790) (431) (28) (114) (12,825) Total transactions during the year 126,513 56,000 (939) (2,861) 1,136 179,849 Cost 624,626 389,040 20,883 14,987 15,203 1,064,739 Accumulated amortisation – ( 58,163) (6,386) (13,658) (5,617) (83,824) Net book value at 31 December 2021 624,626 330,877 14,497 1,329 9,586 980,915 Note: 1. Restated for the initial accounting for the business combinations of Decoded, and Metric Theory (completed and control passed on 31 December 2020) as required by IFRS 3. Goodwill Goodwill represents the excess of consideration over the fair value of the Group’s share of the net identifiable assets of the acquired subsidiary at the date of acquisition. Goodwill – initial accounting The initial accounting of the business combinations as described in Note 4 is incomplete at the end of the reporting period. As of 31 December 2021, the identifiable intangibles acquired are not yet identified and consequently not yet measured and are therefore not deducted from goodwill. During the measurement period in 2022, S4Capital Group will obtain the information necessary to identify and measure the assets and liabilities and retrospectively adjust the provisional amounts recognised at the acquisition date (see Note 4). Goodwill – impairment testing Goodwill acquired through business combinations is allocated to CGUs for impairment testing. The goodwill balance is allocated to the following CGUs: 31 Dec 2021 31 Dec 2020 £000 £000 Technology Services 42,200 – Content 372,043 338,962 Data&Digital Media 210,383 220,960 Total 624,626 559,922 S4Capital Annual Report and Accounts 2021 137

s4 capital annual report and accounts 2021 Page 138 Page 140

s4 capital annual report and accounts 2021 Page 138 Page 140