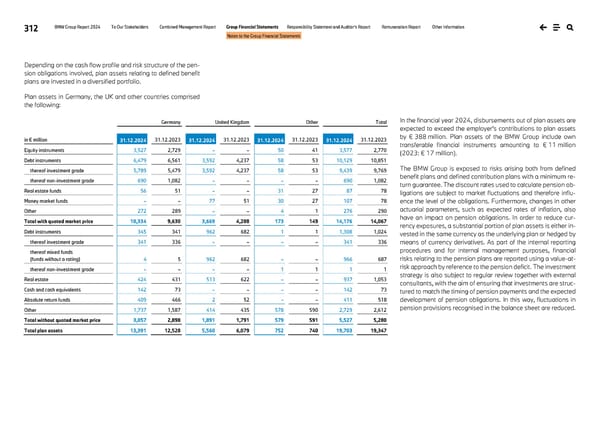

312 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Notes to the Group Financial Statements Depending on the cash flow profile and risk structure of the pen- sion obligations involved, plan assets relating to defined benefit plans are invested in a diversified portfolio. Plan assets in Germany, the UK and other countries comprised the following: In the financial year 2024, disbursements out of plan assets are expected to exceed the employer's contributions to plan assets by € 388 million. Plan assets of the BMW Group include own transferable financial instruments amounting to € 11 million (2023: € 17 million). The BMW Group is exposed to risks arising both from defined benefit plans and defined contribution plans with a minimum re- turn guarantee. The discount rates used to calculate pension ob- ligations are subject to market fluctuations and therefore influ- ence the level of the obligations. Furthermore, changes in other actuarial parameters, such as expected rates of inflation, also have an impact on pension obligations. In order to reduce cur- rency exposures, a substantial portion of plan assets is either in- vested in the same currency as the underlying plan or hedged by means of currency derivatives. As part of the internal reporting procedures and for internal management purposes, financial risks relating to the pension plans are reported using a value-at- risk approach by reference to the pension deficit. The investment strategy is also subject to regular review together with external consultants, with the aim of ensuring that investments are struc- tured to match the timing of pension payments and the expected development of pension obligations. In this way, fluctuations in pension provisions recognised in the balance sheet are reduced. Germany United Kingdom Other Total in € million 31.12.2024 31.12.2023 31.12.2024 31.12.2023 31.12.2024 31.12.2023 31.12.2024 31.12.2023 Equity instruments 3,527 2,729 – – 50 41 3,577 2,770 Debt instruments 6,479 6,561 3,592 4,237 58 53 10,129 10,851 thereof investment grade 5,789 5,479 3,592 4,237 58 53 9,439 9,769 thereof non-investment grade 690 1,082 – – – – 690 1,082 Real estate funds 56 51 – – 31 27 87 78 Money market funds – – 77 51 30 27 107 78 Other 272 289 – – 4 1 276 290 Total with quoted market price 10,334 9,630 3,669 4,288 173 149 14,176 14,067 Debt instruments 345 341 962 682 1 1 1,308 1,024 thereof investment grade 341 336 – – – – 341 336 thereof mixed funds (funds without a rating) 4 5 962 682 – – 966 687 thereof non-investment grade – – – – 1 1 1 1 Real estate 424 431 513 622 – – 937 1,053 Cash and cash equivalents 142 73 – – – – 142 73 Absolute return funds 409 466 2 52 – – 411 518 Other 1,737 1,587 414 435 578 590 2,729 2,612 Total without quoted market price 3,057 2,898 1,891 1,791 579 591 5,527 5,280 Total plan assets 13,391 12,528 5,560 6,079 752 740 19,703 19,347

BMW Group Report 2024 Page 311 Page 313

BMW Group Report 2024 Page 311 Page 313