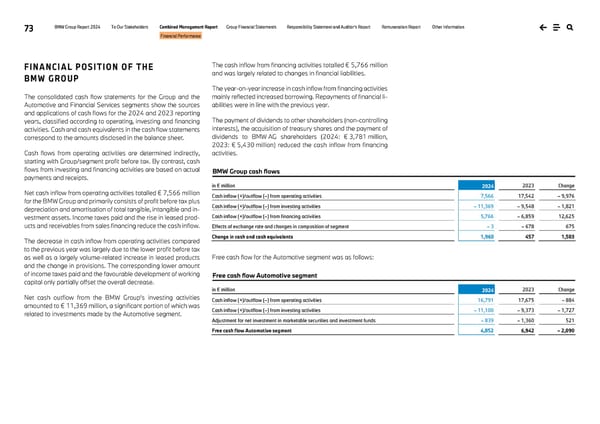

73 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Financial Performance FINANCIAL POSITION OF THE BMW GROUP The consolidated cash flow statements for the Group and the Automotive and Financial Services segments show the sources and applications of cash flows for the 2024 and 2023 reporting years, classified according to operating, investing and financing activities. Cash and cash equivalents in the cash flow statements correspond to the amounts disclosed in the balance sheet. Cash flows from operating activities are determined indirectly, starting with Group/segment profit before tax. By contrast, cash flows from investing and financing activities are based on actual payments and receipts. Net cash inflow from operating activities totalled € 7,566 million for the BMW Group and primarily consists of profit before tax plus depreciation and amortisation of total tangible, intangible and in- vestment assets. Income taxes paid and the rise in leased prod- ucts and receivables from sales financing reduce the cash inflow. The decrease in cash inflow from operating activities compared to the previous year was largely due to the lower profit before tax as well as a largely volume-related increase in leased products and the change in provisions. The corresponding lower amount of income taxes paid and the favourable development of working capital only partially offset the overall decrease. Net cash outflow from the BMW Group’s investing activities amounted to € 11,369 million, a significant portion of which was related to investments made by the Automotive segment. The cash inflow from financing activities totalled € 5,766 million and was largely related to changes in financial liabilities. The year-on-year increase in cash inflow from financing activities mainly reflected increased borrowing. Repayments of financial li- abilities were in line with the previous year. The payment of dividends to other shareholders (non-controlling interests), the acquisition of treasury shares and the payment of dividends to BMW AG shareholders (2024: € 3,781 million, 2023: € 5,430 million) reduced the cash inflow from financing activities. Free cash flow for the Automotive segment was as follows: in € million 2024 2023 Change Cash inflow (+)/outflow (–) from operating activities 7,566 17,542 – 9,976 Cash inflow (+)/outflow (–) from investing activities – 11,369 – 9,548 – 1,821 Cash inflow (+)/outflow (–) from financing activities 5,766 – 6,859 12,625 Effects of exchange rate and changes in composition of segment – 3 – 678 675 Change in cash and cash equivalents 1,960 457 1,503 in € million 2024 2023 Change Cash inflow (+)/outflow (–) from operating activities 16,791 17,675 – 884 Cash inflow (+)/outflow (–) from investing activities – 11,100 – 9,373 – 1,727 Adjustment for net investment in marketable securities and investment funds – 839 – 1,360 521 Free cash flow Automotive segment 4,852 6,942 – 2,090 BMW Group cash flows Free cash flow Automotive segment

BMW Group Report 2024 Page 72 Page 74

BMW Group Report 2024 Page 72 Page 74