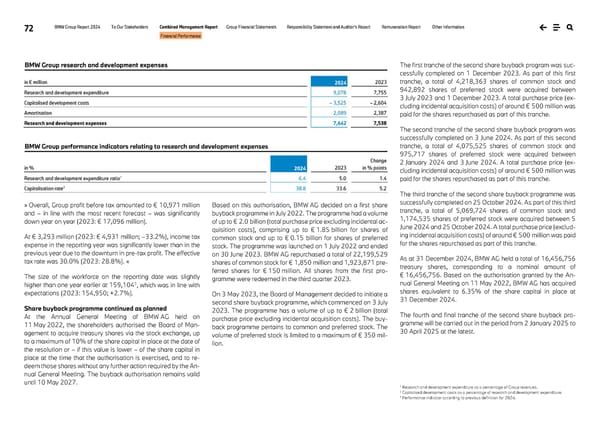

72 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Financial Performance » Overall, Group profit before tax amounted to € 10,971 million and – in line with the most recent forecast – was significantly down year on year (2023: € 17,096 million). At € 3,293 million (2023: € 4,931 million; –33.2%), income tax expense in the reporting year was significantly lower than in the previous year due to the downturn in pre-tax profit. The effective tax rate was 30.0% (2023: 28.8%). « The size of the workforce on the reporting date was slightly higher than one year earlier at 159,1043, which was in line with expectations (2023: 154,950; +2.7%). Share buyback programme continued as planned At the Annual General Meeting of BMW AG held on 11 May 2022, the shareholders authorised the Board of Man- agement to acquire treasury shares via the stock exchange, up to a maximum of 10% of the share capital in place at the date of the resolution or – if this value is lower – of the share capital in place at the time that the authorisation is exercised, and to re- deem those shares without any further action required by the An- nual General Meeting. The buyback authorisation remains valid until 10 May 2027. Based on this authorisation, BMW AG decided on a first share buyback programme in July 2022. The programme had a volume of up to € 2.0 billion (total purchase price excluding incidental ac- quisition costs), comprising up to € 1.85 billion for shares of common stock and up to € 0.15 billion for shares of preferred stock. The programme was launched on 1 July 2022 and ended on 30 June 2023. BMW AG repurchased a total of 22,199,529 shares of common stock for € 1,850 million and 1,923,871 pre- ferred shares for € 150 million. All shares from the first pro- gramme were redeemed in the third quarter 2023. On 3 May 2023, the Board of Management decided to initiate a second share buyback programme, which commenced on 3 July 2023. The programme has a volume of up to € 2 billion (total purchase price excluding incidental acquisition costs). The buy- back programme pertains to common and preferred stock. The volume of preferred stock is limited to a maximum of € 350 mil- lion. The first tranche of the second share buyback program was suc- cessfully completed on 1 December 2023. As part of this first tranche, a total of 4,218,363 shares of common stock and 942,892 shares of preferred stock were acquired between 3 July 2023 and 1 December 2023. A total purchase price (ex- cluding incidental acquisition costs) of around € 500 million was paid for the shares repurchased as part of this tranche. The second tranche of the second share buyback program was successfully completed on 3 June 2024. As part of this second tranche, a total of 4,075,525 shares of common stock and 975,717 shares of preferred stock were acquired between 2 January 2024 and 3 June 2024. A total purchase price (ex- cluding incidental acquisition costs) of around € 500 million was paid for the shares repurchased as part of this tranche. The third tranche of the second share buyback programme was successfully completed on 25 October 2024. As part of this third tranche, a total of 5,069,724 shares of common stock and 1,174,535 shares of preferred stock were acquired between 5 June 2024 and 25 October 2024. A total purchase price (exclud- ing incidental acquisition costs) of around € 500 million was paid for the shares repurchased as part of this tranche. As at 31 December 2024, BMW AG held a total of 16,456,756 treasury shares, corresponding to a nominal amount of € 16,456,756. Based on the authorisation granted by the An- nual General Meeting on 11 May 2022, BMW AG has acquired shares equivalent to 6.35% of the share capital in place at 31 December 2024. The fourth and final tranche of the second share buyback pro- gramme will be carried out in the period from 2 January 2025 to 30 April 2025 at the latest. 1 Research and development expenditure as a percentage of Group revenues. 2 Capitalised development costs as a percentage of research and development expenditure. 3 Performance indicator according to previous definition for 2024. in € million 2024 2023 Research and development expenditure 9,078 7,755 Capitalised development costs – 3,525 – 2,604 Amortisation 2,089 2,387 Research and development expenses 7,642 7,538 in % 2024 2023 Change in % points Research and development expenditure ratio1 6.4 5.0 1.4 Capitalisation rate2 38.8 33.6 5.2 BMW Group performance indicators relating to research and development expenses BMW Group research and development expenses

BMW Group Report 2024 Page 71 Page 73

BMW Group Report 2024 Page 71 Page 73