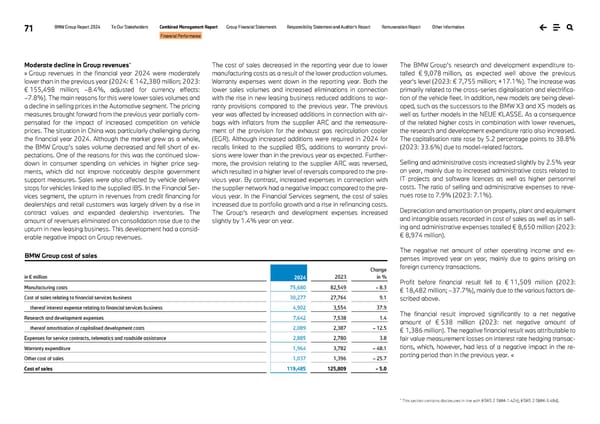

71 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Financial Performance Moderate decline in Group revenues* » Group revenues in the financial year 2024 were moderately lower than in the previous year (2024: € 142,380 million; 2023: € 155,498 million; –8.4%, adjusted for currency effects: –7.8%). The main reasons for this were lower sales volumes and a decline in selling prices in the Automotive segment. The pricing measures brought forward from the previous year partially com- pensated for the impact of increased competition on vehicle prices. The situation in China was particularly challenging during the financial year 2024. Although the market grew as a whole, the BMW Group’s sales volume decreased and fell short of ex- pectations. One of the reasons for this was the continued slow- down in consumer spending on vehicles in higher price seg- ments, which did not improve noticeably despite government support measures. Sales were also affected by vehicle delivery stops for vehicles linked to the supplied IBS. In the Financial Ser- vices segment, the upturn in revenues from credit financing for dealerships and retail customers was largely driven by a rise in contract values and expanded dealership inventories. The amount of revenues eliminated on consolidation rose due to the upturn in new leasing business. This development had a consid- erable negative impact on Group revenues. The cost of sales decreased in the reporting year due to lower manufacturing costs as a result of the lower production volumes. Warranty expenses went down in the reporting year. Both the lower sales volumes and increased eliminations in connection with the rise in new leasing business reduced additions to war- ranty provisions compared to the previous year. The previous year was affected by increased additions in connection with air- bags with inflators from the supplier ARC and the remeasure- ment of the provision for the exhaust gas recirculation cooler (EGR). Although increased additions were required in 2024 for recalls linked to the supplied IBS, additions to warranty provi- sions were lower than in the previous year as expected. Further- more, the provision relating to the supplier ARC was reversed, which resulted in a higher level of reversals compared to the pre- vious year. By contrast, increased expenses in connection with the supplier network had a negative impact compared to the pre- vious year. In the Financial Services segment, the cost of sales increased due to portfolio growth and a rise in refinancing costs. The Group’s research and development expenses increased slightly by 1.4% year on year. The BMW Group’s research and development expenditure to- talled € 9,078 million, as expected well above the previous year’s level (2023: € 7,755 million; +17.1%). The increase was primarily related to the cross-series digitalisation and electrifica- tion of the vehicle fleet. In addition, new models are being devel- oped, such as the successors to the BMW X3 and X5 models as well as further models in the NEUE KLASSE. As a consequence of the related higher costs in combination with lower revenues, the research and development expenditure ratio also increased. The capitalisation rate rose by 5.2 percentage points to 38.8% (2023: 33.6%) due to model-related factors. Selling and administrative costs increased slightly by 2.5% year on year, mainly due to increased administrative costs related to IT projects and software licences as well as higher personnel costs. The ratio of selling and administrative expenses to reve- nues rose to 7.9% (2023: 7.1%). Depreciation and amortisation on property, plant and equipment and intangible assets recorded in cost of sales as well as in sell- ing and administrative expenses totalled € 8,650 million (2023: € 8,974 million). The negative net amount of other operating income and ex- penses improved year on year, mainly due to gains arising on foreign currency transactions. Profit before financial result fell to € 11,509 million (2023: € 18,482 million; –37.7%), mainly due to the various factors de- scribed above. The financial result improved significantly to a net negative amount of € 538 million (2023: net negative amount of € 1,386 million). The negative financial result was attributable to fair value measurement losses on interest rate hedging transac- tions, which, however, had less of a negative impact in the re- porting period than in the previous year. « * This section contains disclosures in line with ESRS 2 SBM-1.42b); ESRS 2 SBM-3.48d). in € million 2024 2023 Change in % Manufacturing costs 75,680 82,549 – 8.3 Cost of sales relating to financial services business 30,277 27,764 9.1 thereof interest expense relating to financial services business 4,902 3,554 37.9 Research and development expenses 7,642 7,538 1.4 thereof amortisation of capitalised development costs 2,089 2,387 – 12.5 Expenses for service contracts, telematics and roadside assistance 2,885 2,780 3.8 Warranty expenditure 1,964 3,782 – 48.1 Other cost of sales 1,037 1,396 – 25.7 Cost of sales 119,485 125,809 – 5.0 BMW Group cost of sales

BMW Group Report 2024 Page 70 Page 72

BMW Group Report 2024 Page 70 Page 72