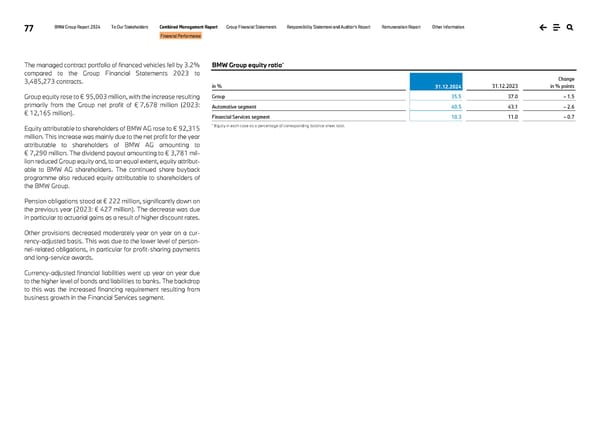

77 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Financial Performance The managed contract portfolio of financed vehicles fell by 3.2% compared to the Group Financial Statements 2023 to 3,485,273 contracts. Group equity rose to € 95,003 million, with the increase resulting primarily from the Group net profit of € 7,678 million (2023: € 12,165 million). Equity attributable to shareholders of BMW AG rose to € 92,315 million. This increase was mainly due to the net profit for the year attributable to shareholders of BMW AG amounting to € 7,290 million. The dividend payout amounting to € 3,781 mil- lion reduced Group equity and, to an equal extent, equity attribut- able to BMW AG shareholders. The continued share buyback programme also reduced equity attributable to shareholders of the BMW Group. Pension obligations stood at € 222 million, significantly down on the previous year (2023: € 427 million). The decrease was due in particular to actuarial gains as a result of higher discount rates. Other provisions decreased moderately year on year on a cur- rency-adjusted basis. This was due to the lower level of person- nel-related obligations, in particular for profit-sharing payments and long-service awards. Currency-adjusted financial liabilities went up year on year due to the higher level of bonds and liabilities to banks. The backdrop to this was the increased financing requirement resulting from business growth in the Financial Services segment. BMW Group equity ratio* in % 31.12.2024 31.12.2023 Change in % points Group 35.5 37.0 – 1.5 Automotive segment 40.5 43.1 – 2.6 Financial Services segment 10.3 11.0 – 0.7 * Equity in each case as a percentage of corresponding balance sheet total.

BMW Group Report 2024 Page 76 Page 78

BMW Group Report 2024 Page 76 Page 78