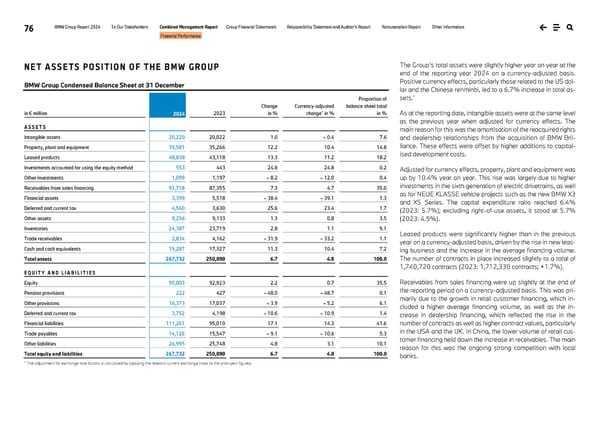

76 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Financial Performance NET ASSETS POSITION OF THE BMW GROUP BMW Group Condensed Balance Sheet at 31 December in € million 2024 2023 Change in % Currency-adjusted change* in % Proportion of balance sheet total in % A S S E T S Intangible assets 20,220 20,022 1.0 – 0.4 7.6 Property, plant and equipment 39,581 35,266 12.2 10.4 14.8 Leased products 48,838 43,118 13.3 11.2 18.2 Investments accounted for using the equity method 553 443 24.8 24.8 0.2 Other investments 1,099 1,197 – 8.2 – 12.0 0.4 Receivables from sales financing 93,718 87,355 7.3 4.7 35.0 Financial assets 3,399 5,518 – 38.4 – 39.1 1.3 Deferred and current tax 4,560 3,630 25.6 23.4 1.7 Other assets 9,256 9,133 1.3 0.8 3.5 Inventories 24,387 23,719 2.8 1.1 9.1 Trade receivables 2,834 4,162 – 31.9 – 33.2 1.1 Cash and cash equivalents 19,287 17,327 11.3 10.4 7.2 Total assets 267,732 250,890 6.7 4.8 100.0 E Q U I T Y A N D L I A B I L I T I E S Equity 95,003 92,923 2.2 0.7 35.5 Pension provisions 222 427 – 48.0 – 48.7 0.1 Other provisions 16,373 17,037 – 3.9 – 5.2 6.1 Deferred and current tax 3,752 4,198 – 10.6 – 10.9 1.4 Financial liabilities 111,261 95,010 17.1 14.3 41.6 Trade payables 14,126 15,547 – 9.1 – 10.6 5.3 Other liabilities 26,995 25,748 4.8 3.1 10.1 Total equity and liabilities 267,732 250,890 6.7 4.8 100.0 * The adjustment for exchange rate factors is calculated by applying the relevant current exchange rates to the prior-year figures. The Group’s total assets were slightly higher year on year at the end of the reporting year 2024 on a currency-adjusted basis. Positive currency effects, particularly those related to the US dol- lar and the Chinese renminbi, led to a 6.7% increase in total as- sets.* As at the reporting date, intangible assets were at the same level as the previous year when adjusted for currency effects. The main reason for this was the amortisation of the reacquired rights and dealership relationships from the acquisition of BMW Bril- liance. These effects were offset by higher additions to capital- ised development costs. Adjusted for currency effects, property, plant and equipment was up by 10.4% year on year. This rise was largely due to higher investments in the sixth generation of electric drivetrains, as well as for NEUE KLASSE vehicle projects such as the new BMW X3 and X5 Series. The capital expenditure ratio reached 6.4% (2023: 5.7%); excluding right-of-use assets, it stood at 5.7% (2023: 4.9%). Leased products were significantly higher than in the previous year on a currency-adjusted basis, driven by the rise in new leas- ing business and the increase in the average financing volume. The number of contracts in place increased slightly to a total of 1,740,720 contracts (2023: 1,712,330 contracts; +1.7%). Receivables from sales financing were up slightly at the end of the reporting period on a currency-adjusted basis. This was pri- marily due to the growth in retail customer financing, which in- cluded a higher average financing volume, as well as the in- crease in dealership financing, which reflected the rise in the number of contracts as well as higher contract values, particularly in the USA and the UK. In China, the lower volume of retail cus- tomer financing held down the increase in receivables. The main reason for this was the ongoing strong competition with local banks.

BMW Group Report 2024 Page 75 Page 77

BMW Group Report 2024 Page 75 Page 77