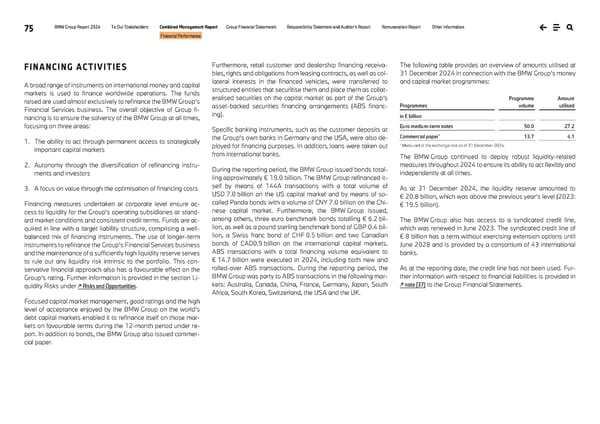

75 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Financial Performance FINANCING ACTIVITIES A broad range of instruments on international money and capital markets is used to finance worldwide operations. The funds raised are used almost exclusively to refinance the BMW Group’s Financial Services business. The overall objective of Group fi- nancing is to ensure the solvency of the BMW Group at all times, focusing on three areas: 1. The ability to act through permanent access to strategically important capital markets 2. Autonomy through the diversification of refinancing instru- ments and investors 3. A focus on value through the optimisation of financing costs Financing measures undertaken at corporate level ensure ac- cess to liquidity for the Group’s operating subsidiaries at stand- ard market conditions and consistent credit terms. Funds are ac- quired in line with a target liability structure, comprising a well- balanced mix of financing instruments. The use of longer-term instruments to refinance the Group’s Financial Services business and the maintenance of a sufficiently high liquidity reserve serves to rule out any liquidity risk intrinsic to the portfolio. This con- servative financial approach also has a favourable effect on the Group’s rating. Further information is provided in the section Li- quidity Risks under ↗ Risks and Opportunities. Focused capital market management, good ratings and the high level of acceptance enjoyed by the BMW Group on the world’s debt capital markets enabled it to refinance itself on those mar- kets on favourable terms during the 12-month period under re- port. In addition to bonds, the BMW Group also issued commer- cial paper. Furthermore, retail customer and dealership financing receiva- bles, rights and obligations from leasing contracts, as well as col- lateral interests in the financed vehicles, were transferred to structured entities that securitise them and place them as collat- eralised securities on the capital market as part of the Group’s asset-backed securities financing arrangements (ABS financ- ing). Specific banking instruments, such as the customer deposits at the Group’s own banks in Germany and the USA, were also de- ployed for financing purposes. In addition, loans were taken out from international banks. During the reporting period, the BMW Group issued bonds total- ling approximately € 19.0 billion. The BMW Group refinanced it- self by means of 144A transactions with a total volume of USD 7.0 billion on the US capital market and by means of so- called Panda bonds with a volume of CNY 7.0 billion on the Chi- nese capital market. Furthermore, the BMW Group issued, among others, three euro benchmark bonds totalling € 6.2 bil- lion, as well as a pound sterling benchmark bond of GBP 0.4 bil- lion, a Swiss franc bond of CHF 0.5 billion and two Canadian bonds of CAD0.9 billion on the international capital markets. ABS transactions with a total financing volume equivalent to € 14.7 billion were executed in 2024, including both new and rolled-over ABS transactions. During the reporting period, the BMW Group was party to ABS transactions in the following mar- kets: Australia, Canada, China, France, Germany, Japan, South Africa, South Korea, Switzerland, the USA and the UK. The following table provides an overview of amounts utilised at 31 December 2024 in connection with the BMW Group’s money and capital market programmes: Programmes Programme volume Amount utilised in € billion Euro medium-term notes 50.0 27.2 Commercial paper* 13.7 4.1 * Measured at the exchange rate as of 31 December 2024. The BMW Group continued to deploy robust liquidity-related measures throughout 2024 to ensure its ability to act flexibly and independently at all times. As at 31 December 2024, the liquidity reserve amounted to € 20.8 billion, which was above the previous year’s level (2023: € 19.5 billion). The BMW Group also has access to a syndicated credit line, which was renewed in June 2023. The syndicated credit line of € 8 billion has a term without exercising extension options until June 2028 and is provided by a consortium of 43 international banks. As at the reporting date, the credit line has not been used. Fur- ther information with respect to financial liabilities is provided in ↗ note [37] to the Group Financial Statements.

BMW Group Report 2024 Page 74 Page 76

BMW Group Report 2024 Page 74 Page 76