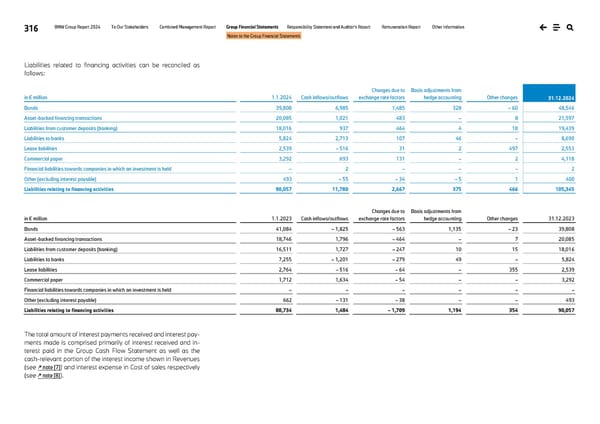

316 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Notes to the Group Financial Statements Liabilities related to financing activities can be reconciled as follows: in € million 1.1.2024 Cash inflows/outflows Changes due to exchange rate factors Basis adjustments from hedge accounting Other changes 31.12.2024 Bonds 39,808 6,985 1,485 328 – 60 48,546 Asset-backed financing transactions 20,085 1,021 483 – 8 21,597 Liabilities from customer deposits (banking) 18,016 937 464 4 18 19,439 Liabilities to banks 5,824 2,713 107 46 – 8,690 Lease liabilities 2,539 – 516 31 2 497 2,553 Commercial paper 3,292 693 131 – 2 4,118 Financial liabilities towards companies in which an investment is held – 2 – – – 2 Other (excluding interest payable) 493 – 55 – 34 – 5 1 400 Liabilities relating to financing activities 90,057 11,780 2,667 375 466 105,345 in € million 1.1.2023 Cash inflows/outflows Changes due to exchange rate factors Basis adjustments from hedge accounting Other changes 31.12.2023 Bonds 41,084 – 1,825 – 563 1,135 – 23 39,808 Asset-backed financing transactions 18,746 1,796 – 464 – 7 20,085 Liabilities from customer deposits (banking) 16,511 1,727 – 247 10 15 18,016 Liabilities to banks 7,255 – 1,201 – 279 49 – 5,824 Lease liabilities 2,764 – 516 – 64 – 355 2,539 Commercial paper 1,712 1,634 – 54 – – 3,292 Financial liabilities towards companies in which an investment is held – – – – – – Other (excluding interest payable) 662 – 131 – 38 – – 493 Liabilities relating to financing activities 88,734 1,484 – 1,709 1,194 354 90,057 The total amount of interest payments received and interest pay- ments made is comprised primarily of interest received and in- terest paid in the Group Cash Flow Statement as well as the cash-relevant portion of the interest income shown in Revenues (see ↗ note [7]) and interest expense in Cost of sales respectively (see ↗ note [8]).

BMW Group Report 2024 Page 315 Page 317

BMW Group Report 2024 Page 315 Page 317