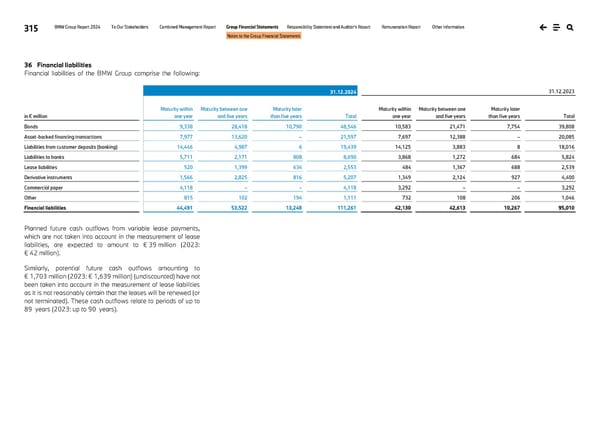

315 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Notes to the Group Financial Statements 36 Financial liabilities Financial liabilities of the BMW Group comprise the following: 31.12.2024 31.12.2023 in € million Maturity within one year Maturity between one and five years Maturity later than five years Total Maturity within one year Maturity between one and five years Maturity later than five years Total Bonds 9,338 28,418 10,790 48,546 10,583 21,471 7,754 39,808 Asset-backed financing transactions 7,977 13,620 – 21,597 7,697 12,388 – 20,085 Liabilities from customer deposits (banking) 14,446 4,987 6 19,439 14,125 3,883 8 18,016 Liabilities to banks 5,711 2,171 808 8,690 3,868 1,272 684 5,824 Lease liabilities 520 1,399 634 2,553 484 1,367 688 2,539 Derivative instruments 1,566 2,825 816 5,207 1,349 2,124 927 4,400 Commercial paper 4,118 – – 4,118 3,292 – – 3,292 Other 815 102 194 1,111 732 108 206 1,046 Financial liabilities 44,491 53,522 13,248 111,261 42,130 42,613 10,267 95,010 Planned future cash outflows from variable lease payments, which are not taken into account in the measurement of lease liabilities, are expected to amount to € 39 million (2023: € 42 million). Similarly, potential future cash outflows amounting to € 1,703 million (2023: € 1,639 million) (undiscounted) have not been taken into account in the measurement of lease liabilities as it is not reasonably certain that the leases will be renewed (or not terminated). These cash outflows relate to periods of up to 89 years (2023: up to 90 years).

BMW Group Report 2024 Page 314 Page 316

BMW Group Report 2024 Page 314 Page 316