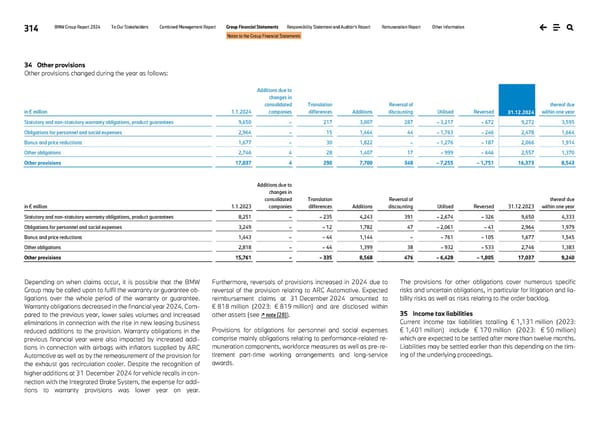

314 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Notes to the Group Financial Statements 34 Other provisions Other provisions changed during the year as follows: in € million 1.1.2024 Additions due to changes in consolidated companies Translation differences Additions Reversal of discounting Utilised Reversed 31.12.2024 thereof due within one year Statutory and non-statutory warranty obligations, product guarantees 9,650 – 217 3,007 287 – 3,217 – 672 9,272 3,595 Obligations for personnel and social expenses 2,964 – 15 1,464 44 – 1,763 – 246 2,478 1,664 Bonus and price reductions 1,677 – 30 1,822 – – 1,276 – 187 2,066 1,914 Other obligations 2,746 4 28 1,407 17 – 999 – 646 2,557 1,370 Other provisions 17,037 4 290 7,700 348 – 7,255 – 1,751 16,373 8,543 in € million 1.1.2023 Additions due to changes in consolidated companies Translation differences Additions Reversal of discounting Utilised Reversed 31.12.2023 thereof due within one year Statutory and non-statutory warranty obligations, product guarantees 8,251 – – 235 4,243 391 – 2,674 – 326 9,650 4,333 Obligations for personnel and social expenses 3,249 – – 12 1,782 47 – 2,061 – 41 2,964 1,979 Bonus and price reductions 1,443 – – 44 1,144 – – 761 – 105 1,677 1,545 Other obligations 2,818 – – 44 1,399 38 – 932 – 533 2,746 1,383 Other provisions 15,761 – – 335 8,568 476 – 6,428 – 1,005 17,037 9,240 Depending on when claims occur, it is possible that the BMW Group may be called upon to fulfil the warranty or guarantee ob- ligations over the whole period of the warranty or guarantee. Warranty obligations decreased in the financial year 2024. Com- pared to the previous year, lower sales volumes and increased eliminations in connection with the rise in new leasing business reduced additions to the provision. Warranty obligations in the previous financial year were also impacted by increased addi- tions in connection with airbags with inflators supplied by ARC Automotive as well as by the remeasurement of the provision for the exhaust gas recirculation cooler. Despite the recognition of higher additions at 31 December 2024 for vehicle recalls in con- nection with the Integrated Brake System, the expense for addi- tions to warranty provisions was lower year on year. Furthermore, reversals of provisions increased in 2024 due to reversal of the provision relating to ARC Automotive. Expected reimbursement claims at 31 December 2024 amounted to € 818 million (2023: € 819 million) and are disclosed within other assets (see ↗ note [28]). Provisions for obligations for personnel and social expenses comprise mainly obligations relating to performance-related re- muneration components, workforce measures as well as pre-re- tirement part-time working arrangements and long-service awards. The provisions for other obligations cover numerous specific risks and uncertain obligations, in particular for litigation and lia- bility risks as well as risks relating to the order backlog. 35 Income tax liabilities Current income tax liabilities totalling € 1,131 million (2023: € 1,401 million) include € 170 million (2023: € 50 million) which are expected to be settled after more than twelve months. Liabilities may be settled earlier than this depending on the tim- ing of the underlying proceedings.

BMW Group Report 2024 Page 313 Page 315

BMW Group Report 2024 Page 313 Page 315