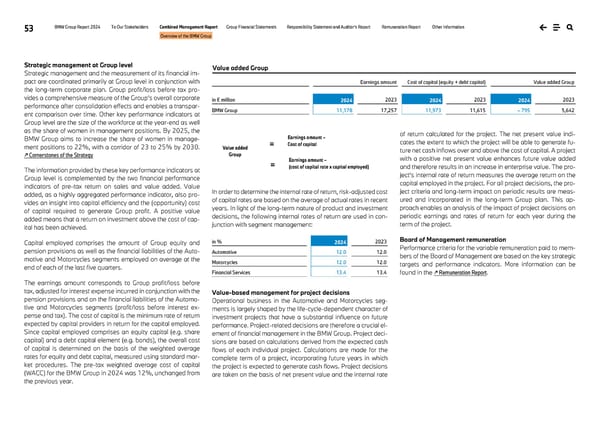

53 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Overview of the BMW Group Strategic management at Group level Strategic management and the measurement of its financial im- pact are coordinated primarily at Group level in conjunction with the long-term corporate plan. Group profit/loss before tax pro- vides a comprehensive measure of the Group’s overall corporate performance after consolidation effects and enables a transpar- ent comparison over time. Other key performance indicators at Group level are the size of the workforce at the year-end as well as the share of women in management positions. By 2025, the BMW Group aims to increase the share of women in manage- ment positions to 22%, with a corridor of 23 to 25% by 2030. ↗ Cornerstones of the Strategy The information provided by these key performance indicators at Group level is complemented by the two financial performance indicators of pre-tax return on sales and value added. Value added, as a highly aggregated performance indicator, also pro- vides an insight into capital efficiency and the (opportunity) cost of capital required to generate Group profit. A positive value added means that a return on investment above the cost of cap- ital has been achieved. Capital employed comprises the amount of Group equity and pension provisions as well as the financial liabilities of the Auto- motive and Motorcycles segments employed on average at the end of each of the last five quarters. The earnings amount corresponds to Group profit/loss before tax, adjusted for interest expense incurred in conjunction with the pension provisions and on the financial liabilities of the Automo- tive and Motorcycles segments (profit/loss before interest ex- pense and tax). The cost of capital is the minimum rate of return expected by capital providers in return for the capital employed. Since capital employed comprises an equity capital (e.g. share capital) and a debt capital element (e.g. bonds), the overall cost of capital is determined on the basis of the weighted average rates for equity and debt capital, measured using standard mar- ket procedures. The pre-tax weighted average cost of capital (WACC) for the BMW Group in 2024 was 12%, unchanged from the previous year. In order to determine the internal rate of return, risk-adjusted cost of capital rates are based on the average of actual rates in recent years. In light of the long-term nature of product and investment decisions, the following internal rates of return are used in con- junction with segment management: in % 2024 2023 Automotive 12.0 12.0 Motorcycles 12.0 12.0 Financial Services 13.4 13.4 Value-based management for project decisions Operational business in the Automotive and Motorcycles seg- ments is largely shaped by the life-cycle-dependent character of investment projects that have a substantial influence on future performance. Project-related decisions are therefore a crucial el- ement of financial management in the BMW Group. Project deci- sions are based on calculations derived from the expected cash flows of each individual project. Calculations are made for the complete term of a project, incorporating future years in which the project is expected to generate cash flows. Project decisions are taken on the basis of net present value and the internal rate of return calculated for the project. The net present value indi- cates the extent to which the project will be able to generate fu- ture net cash inflows over and above the cost of capital. A project with a positive net present value enhances future value added and therefore results in an increase in enterprise value. The pro- ject’s internal rate of return measures the average return on the capital employed in the project. For all project decisions, the pro- ject criteria and long-term impact on periodic results are meas- ured and incorporated in the long-term Group plan. This ap- proach enables an analysis of the impact of project decisions on periodic earnings and rates of return for each year during the term of the project. Board of Management remuneration Performance criteria for the variable remuneration paid to mem- bers of the Board of Management are based on the key strategic targets and performance indicators. More information can be found in the ↗ Remuneration Report. Earnings amount Cost of capital (equity + debt capital) Value added Group in € million 2024 2023 2024 2023 2024 2023 BMW Group 11,178 17,257 11,973 11,615 – 795 5,642 Earnings amount – Cost of capital Value added Group Earnings amount – (cost of capital rate x capital employed) = = Value added Group

BMW Group Report 2024 Page 52 Page 54

BMW Group Report 2024 Page 52 Page 54