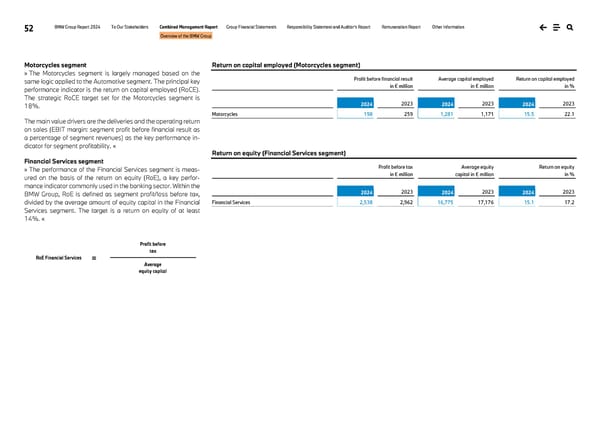

52 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Overview of the BMW Group Motorcycles segment » The Motorcycles segment is largely managed based on the same logic applied to the Automotive segment. The principal key performance indicator is the return on capital employed (RoCE). The strategic RoCE target set for the Motorcycles segment is 18%. The main value drivers are the deliveries and the operating return on sales (EBIT margin: segment profit before financial result as a percentage of segment revenues) as the key performance in- dicator for segment profitability. « Financial Services segment » The performance of the Financial Services segment is meas- ured on the basis of the return on equity (RoE), a key perfor- mance indicator commonly used in the banking sector. Within the BMW Group, RoE is defined as segment profit/loss before tax, divided by the average amount of equity capital in the Financial Services segment. The target is a return on equity of at least 14%. « Return on capital employed (Motorcycles segment) Profit before financial result in € million Average capital employed in € million Return on capital employed in % 2024 2023 2024 2023 2024 2023 Motorcycles 198 259 1,281 1,171 15.5 22.1 Return on equity (Financial Services segment) Profit before tax in € million Average equity capital in € million Return on equity in % 2024 2023 2024 2023 2024 2023 Financial Services 2,538 2,962 16,775 17,176 15.1 17.2 Average equity capital Profit before tax = RoE Financial Services

BMW Group Report 2024 Page 51 Page 53

BMW Group Report 2024 Page 51 Page 53