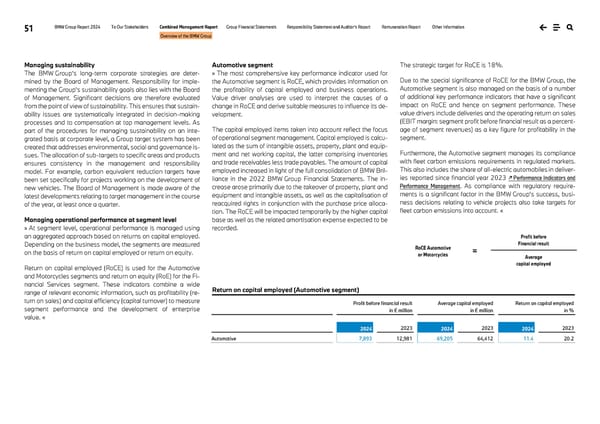

51 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Overview of the BMW Group Managing sustainability The BMW Group’s long-term corporate strategies are deter- mined by the Board of Management. Responsibility for imple- menting the Group’s sustainability goals also lies with the Board of Management. Significant decisions are therefore evaluated from the point of view of sustainability. This ensures that sustain- ability issues are systematically integrated in decision-making processes and to compensation at top management levels. As part of the procedures for managing sustainability on an inte- grated basis at corporate level, a Group target system has been created that addresses environmental, social and governance is- sues. The allocation of sub-targets to specific areas and products ensures consistency in the management and responsibility model. For example, carbon equivalent reduction targets have been set specifically for projects working on the development of new vehicles. The Board of Management is made aware of the latest developments relating to target management in the course of the year, at least once a quarter. Managing operational performance at segment level » At segment level, operational performance is managed using an aggregated approach based on returns on capital employed. Depending on the business model, the segments are measured on the basis of return on capital employed or return on equity. Return on capital employed (RoCE) is used for the Automotive and Motorcycles segments and return on equity (RoE) for the Fi- nancial Services segment. These indicators combine a wide range of relevant economic information, such as profitability (re- turn on sales) and capital efficiency (capital turnover) to measure segment performance and the development of enterprise value. « Automotive segment » The most comprehensive key performance indicator used for the Automotive segment is RoCE, which provides information on the profitability of capital employed and business operations. Value driver analyses are used to interpret the causes of a change in RoCE and derive suitable measures to influence its de- velopment. The capital employed items taken into account reflect the focus of operational segment management. Capital employed is calcu- lated as the sum of intangible assets, property, plant and equip- ment and net working capital, the latter comprising inventories and trade receivables less trade payables. The amount of capital employed increased in light of the full consolidation of BMW Bril- liance in the 2022 BMW Group Financial Statements. The in- crease arose primarily due to the takeover of property, plant and equipment and intangible assets, as well as the capitalisation of reacquired rights in conjunction with the purchase price alloca- tion. The RoCE will be impacted temporarily by the higher capital base as well as the related amortisation expense expected to be recorded. The strategic target for RoCE is 18%. Due to the special significance of RoCE for the BMW Group, the Automotive segment is also managed on the basis of a number of additional key performance indicators that have a significant impact on RoCE and hence on segment performance. These value drivers include deliveries and the operating return on sales (EBIT margin: segment profit before financial result as a percent- age of segment revenues) as a key figure for profitability in the segment. Furthermore, the Automotive segment manages its compliance with fleet carbon emissions requirements in regulated markets. This also includes the share of all-electric automobiles in deliver- ies reported since financial year 2023 ↗ Performance Indicators and Performance Management. As compliance with regulatory require- ments is a significant factor in the BMW Group’s success, busi- ness decisions relating to vehicle projects also take targets for fleet carbon emissions into account. « Profit before financial result in € million Average capital employed in € million Return on capital employed in % 2024 2023 2024 2023 2024 2023 Automotive 7,893 12,981 69,205 64,412 11.4 20.2 Average capital employed Profit before Financial result = RoCE Automotive or Motorcycles Return on capital employed (Automotive segment)

BMW Group Report 2024 Page 50 Page 52

BMW Group Report 2024 Page 50 Page 52