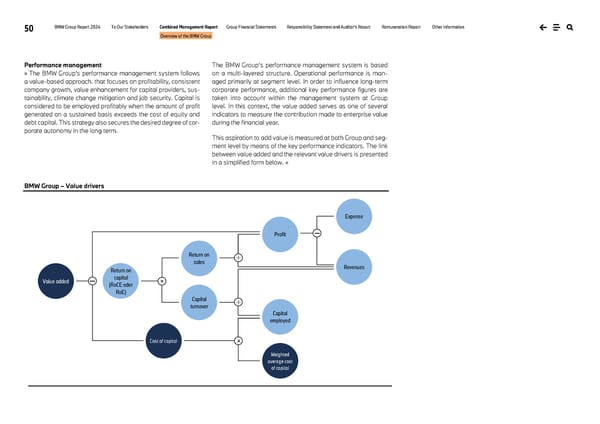

50 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Overview of the BMW Group Performance management » The BMW Group’s performance management system follows a value-based approach. that focuses on profitability, consistent company growth, value enhancement for capital providers, sus- tainability, climate change mitigation and job security. Capital is considered to be employed profitably when the amount of profit generated on a sustained basis exceeds the cost of equity and debt capital. This strategy also secures the desired degree of cor- porate autonomy in the long term. The BMW Group’s performance management system is based on a multi-layered structure. Operational performance is man- aged primarily at segment level. In order to influence long-term corporate performance, additional key performance figures are taken into account within the management system at Group level. In this context, the value added serves as one of several indicators to measure the contribution made to enterprise value during the financial year. This aspiration to add value is measured at both Group and seg- ment level by means of the key performance indicators. The link between value added and the relevant value drivers is presented in a simplified form below. « BMW Group – Value drivers Expense Revenues Profit Capital employed Weighted average cost of capital Cost of capital Value added Return on sales Capital turnover Return on capital (RoCE oder RoE) ÷ ÷ × − × −

BMW Group Report 2024 Page 49 Page 51

BMW Group Report 2024 Page 49 Page 51