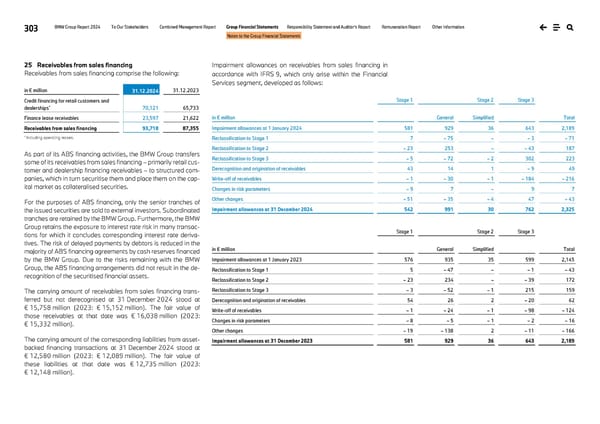

303 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Notes to the Group Financial Statements 25 Receivables from sales financing Receivables from sales financing comprise the following: in € million 31.12.2024 31.12.2023 Credit financing for retail customers and dealerships* 70,121 65,733 Finance lease receivables 23,597 21,622 Receivables from sales financing 93,718 87,355 * Including operating leases. As part of its ABS financing activities, the BMW Group transfers some of its receivables from sales financing – primarily retail cus- tomer and dealership financing receivables – to structured com- panies, which in turn securitise them and place them on the cap- ital market as collateralised securities. For the purposes of ABS financing, only the senior tranches of the issued securities are sold to external investors. Subordinated tranches are retained by the BMW Group. Furthermore, the BMW Group retains the exposure to interest rate risk in many transac- tions for which it concludes corresponding interest rate deriva- tives. The risk of delayed payments by debtors is reduced in the majority of ABS financing agreements by cash reserves financed by the BMW Group. Due to the risks remaining with the BMW Group, the ABS financing arrangements did not result in the de- recognition of the securitised financial assets. The carrying amount of receivables from sales financing trans- ferred but not derecognised at 31 December 2024 stood at € 15,758 million (2023: € 15,152 million). The fair value of those receivables at that date was € 16,038 million (2023: € 15,332 million). The carrying amount of the corresponding liabilities from asset- backed financing transactions at 31 December 2024 stood at € 12,580 million (2023: € 12,089 million). The fair value of these liabilities at that date was € 12,735 million (2023: € 12,148 million). Impairment allowances on receivables from sales financing in accordance with IFRS 9, which only arise within the Financial Services segment, developed as follows: Stage 1 Stage 2 Stage 3 in € million General Simplified Total Impairment allowances at 1 January 2024 581 929 36 643 2,189 Reclassification to Stage 1 7 – 75 – – 3 – 71 Reclassification to Stage 2 – 23 253 – – 43 187 Reclassification to Stage 3 – 5 – 72 – 2 302 223 Derecognition and origination of receivables 43 14 1 – 9 49 Write-off of receivables – 1 – 30 – 1 – 184 – 216 Changes in risk parameters – 9 7 – 9 7 Other changes – 51 – 35 – 4 47 – 43 Impairment allowances at 31 December 2024 542 991 30 762 2,325 Stage 1 Stage 2 Stage 3 in € million General Simplified Total Impairment allowances at 1 January 2023 576 935 35 599 2,145 Reclassification to Stage 1 5 – 47 – – 1 – 43 Reclassification to Stage 2 – 23 234 – – 39 172 Reclassification to Stage 3 – 3 – 52 – 1 215 159 Derecognition and origination of receivables 54 26 2 – 20 62 Write-off of receivables – 1 – 24 – 1 – 98 – 124 Changes in risk parameters – 8 – 5 – 1 – 2 – 16 Other changes – 19 – 138 2 – 11 – 166 Impairment allowances at 31 December 2023 581 929 36 643 2,189

BMW Group Report 2024 Page 302 Page 304

BMW Group Report 2024 Page 302 Page 304