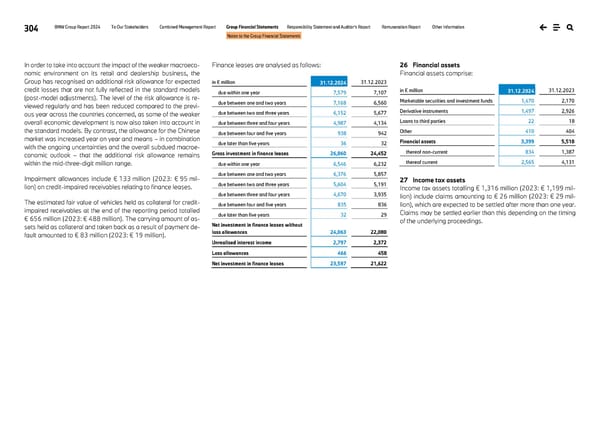

304 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Notes to the Group Financial Statements In order to take into account the impact of the weaker macroeco- nomic environment on its retail and dealership business, the Group has recognised an additional risk allowance for expected credit losses that are not fully reflected in the standard models (post-model adjustments). The level of the risk allowance is re- viewed regularly and has been reduced compared to the previ- ous year across the countries concerned, as some of the weaker overall economic development is now also taken into account in the standard models. By contrast, the allowance for the Chinese market was increased year on year and means – in combination with the ongoing uncertainties and the overall subdued macroe- conomic outlook – that the additional risk allowance remains within the mid-three-digit million range. Impairment allowances include € 133 million (2023: € 95 mil- lion) on credit-impaired receivables relating to finance leases. The estimated fair value of vehicles held as collateral for credit- impaired receivables at the end of the reporting period totalled € 656 million (2023: € 488 million). The carrying amount of as- sets held as collateral and taken back as a result of payment de- fault amounted to € 83 million (2023: € 19 million). Finance leases are analysed as follows: in € million 31.12.2024 31.12.2023 due within one year 7,579 7,107 due between one and two years 7,168 6,560 due between two and three years 6,152 5,677 due between three and four years 4,987 4,134 due between four and five years 938 942 due later than five years 36 32 Gross investment in finance leases 26,860 24,452 due within one year 6,546 6,232 due between one and two years 6,376 5,857 due between two and three years 5,604 5,191 due between three and four years 4,670 3,935 due between four and five years 835 836 due later than five years 32 29 Net investment in finance leases without loss allowances 24,063 22,080 Unrealised interest income 2,797 2,372 Loss allowances 466 458 Net investment in finance leases 23,597 21,622 26 Financial assets Financial assets comprise: in € million 31.12.2024 31.12.2023 Marketable securities and investment funds 1,470 2,170 Derivative instruments 1,497 2,926 Loans to third parties 22 18 Other 410 404 Financial assets 3,399 5,518 thereof non-current 834 1,387 thereof current 2,565 4,131 27 Income tax assets Income tax assets totalling € 1,316 million (2023: € 1,199 mil- lion) include claims amounting to € 26 million (2023: € 29 mil- lion), which are expected to be settled after more than one year. Claims may be settled earlier than this depending on the timing of the underlying proceedings.

BMW Group Report 2024 Page 303 Page 305

BMW Group Report 2024 Page 303 Page 305