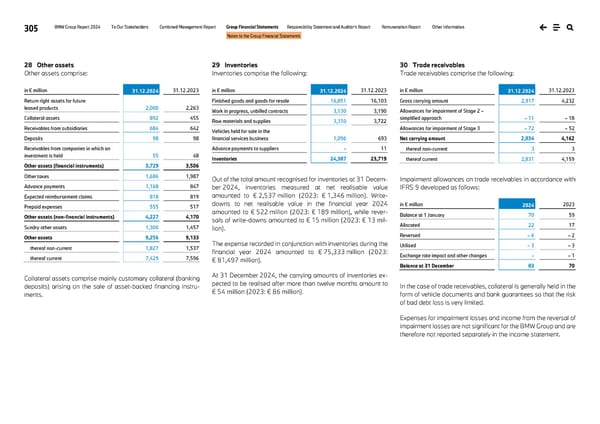

305 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Notes to the Group Financial Statements 28 Other assets Other assets comprise: in € million 31.12.2024 31.12.2023 Return right assets for future leased products 2,000 2,263 Collateral assets 892 455 Receivables from subsidiaries 684 642 Deposits 98 98 Receivables from companies in which an investment is held 55 48 Other assets (financial instruments) 3,729 3,506 Other taxes 1,686 1,987 Advance payments 1,168 847 Expected reimbursement claims 818 819 Prepaid expenses 555 517 Other assets (non-financial instruments) 4,227 4,170 Sundry other assets 1,300 1,457 Other assets 9,256 9,133 thereof non-current 1,827 1,537 thereof current 7,429 7,596 Collateral assets comprise mainly customary collateral (banking deposits) arising on the sale of asset-backed financing instru- ments. 29 Inventories Inventories comprise the following: in € million 31.12.2024 31.12.2023 Finished goods and goods for resale 16,851 16,103 Work in progress, unbilled contracts 3,130 3,190 Raw materials and supplies 3,310 3,722 Vehicles held for sale in the financial services business 1,096 693 Advance payments to suppliers – 11 Inventories 24,387 23,719 Out of the total amount recognised for inventories at 31 Decem- ber 2024, inventories measured at net realisable value amounted to € 2,537 million (2023: € 1,346 million). Write- downs to net realisable value in the financial year 2024 amounted to € 522 million (2023: € 189 million), while rever- sals of write-downs amounted to € 15 million (2023: € 13 mil- lion). The expense recorded in conjunction with inventories during the financial year 2024 amounted to € 75,333 million (2023: € 81,497 million). At 31 December 2024, the carrying amounts of inventories ex- pected to be realised after more than twelve months amount to € 54 million (2023: € 86 million). 30 Trade receivables Trade receivables comprise the following: in € million 31.12.2024 31.12.2023 Gross carrying amount 2,917 4,232 Allowances for impairment of Stage 2 – simplified approach – 11 – 18 Allowances for impairment of Stage 3 – 72 – 52 Net carrying amount 2,834 4,162 thereof non-current 3 3 thereof current 2,831 4,159 Impairment allowances on trade receivables in accordance with IFRS 9 developed as follows: in € million 2024 2023 Balance at 1 January 70 59 Allocated 22 17 Reversed – 6 – 2 Utilised – 3 – 3 Exchange rate impact and other changes – – 1 Balance at 31 December 83 70 In the case of trade receivables, collateral is generally held in the form of vehicle documents and bank guarantees so that the risk of bad debt loss is very limited. Expenses for impairment losses and income from the reversal of impairment losses are not significant for the BMW Group and are therefore not reported separately in the income statement.

BMW Group Report 2024 Page 304 Page 306

BMW Group Report 2024 Page 304 Page 306