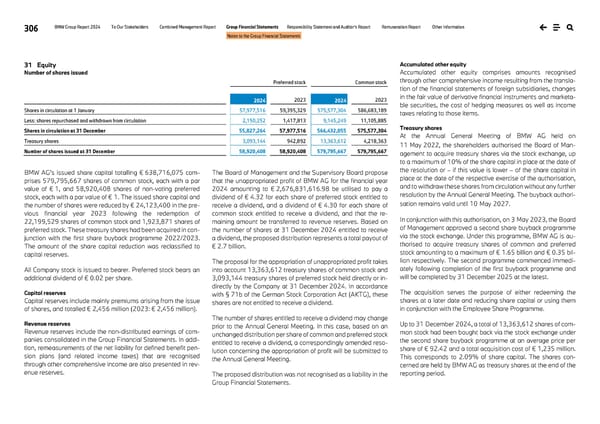

306 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Notes to the Group Financial Statements 31 Equity Number of shares issued BMW AG's issued share capital totalling € 638,716,075 com- prises 579,795,667 shares of common stock, each with a par value of € 1, and 58,920,408 shares of non-voting preferred stock, each with a par value of € 1. The issued share capital and the number of shares were reduced by € 24,123,400 in the pre- vious financial year 2023 following the redemption of 22,199,529 shares of common stock and 1,923,871 shares of preferred stock. These treasury shares had been acquired in con- junction with the first share buyback programme 2022/2023. The amount of the share capital reduction was reclassified to capital reserves. All Company stock is issued to bearer. Preferred stock bears an additional dividend of € 0.02 per share. Capital reserves Capital reserves include mainly premiums arising from the issue of shares, and totalled € 2,456 million (2023: € 2,456 million). Revenue reserves Revenue reserves include the non-distributed earnings of com- panies consolidated in the Group Financial Statements. In addi- tion, remeasurements of the net liability for defined benefit pen- sion plans (and related income taxes) that are recognised through other comprehensive income are also presented in rev- enue reserves. The Board of Management and the Supervisory Board propose that the unappropriated profit of BMW AG for the financial year 2024 amounting to € 2,676,831,616.98 be utilised to pay a dividend of € 4.32 for each share of preferred stock entitled to receive a dividend, and a dividend of € 4.30 for each share of common stock entitled to receive a dividend, and that the re- maining amount be transferred to revenue reserves. Based on the number of shares at 31 December 2024 entitled to receive a dividend, the proposed distribution represents a total payout of € 2.7 billion. The proposal for the appropriation of unappropriated profit takes into account 13,363,612 treasury shares of common stock and 3,093,144 treasury shares of preferred stock held directly or in- directly by the Company at 31 December 2024. In accordance with § 71b of the German Stock Corporation Act (AKTG), these shares are not entitled to receive a dividend. The number of shares entitled to receive a dividend may change prior to the Annual General Meeting. In this case, based on an unchanged distribution per share of common and preferred stock entitled to receive a dividend, a correspondingly amended reso- lution concerning the appropriation of profit will be submitted to the Annual General Meeting. The proposed distribution was not recognised as a liability in the Group Financial Statements. Accumulated other equity Accumulated other equity comprises amounts recognised through other comprehensive income resulting from the transla- tion of the financial statements of foreign subsidiaries, changes in the fair value of derivative financial instruments and marketa- ble securities, the cost of hedging measures as well as income taxes relating to those items. Treasury shares At the Annual General Meeting of BMW AG held on 11 May 2022, the shareholders authorised the Board of Man- agement to acquire treasury shares via the stock exchange, up to a maximum of 10% of the share capital in place at the date of the resolution or – if this value is lower – of the share capital in place at the date of the respective exercise of the authorisation, and to withdraw these shares from circulation without any further resolution by the Annual General Meeting. The buyback authori- sation remains valid until 10 May 2027. In conjunction with this authorisation, on 3 May 2023, the Board of Management approved a second share buyback programme via the stock exchange. Under this programme, BMW AG is au- thorised to acquire treasury shares of common and preferred stock amounting to a maximum of € 1.65 billion and € 0.35 bil- lion respectively. The second programme commenced immedi- ately following completion of the first buyback programme and will be completed by 31 December 2025 at the latest. The acquisition serves the purpose of either redeeming the shares at a later date and reducing share capital or using them in conjunction with the Employee Share Programme. Up to 31 December 2024, a total of 13,363,612 shares of com- mon stock had been bought back via the stock exchange under the second share buyback programme at an average price per share of € 92.42 and a total acquisition cost of € 1,235 million. This corresponds to 2.09% of share capital. The shares con- cerned are held by BMW AG as treasury shares at the end of the reporting period. Preferred stock Common stock 2024 2023 2024 2023 Shares in circulation at 1 January 57,977,516 59,395,329 575,577,304 586,683,189 Less: shares repurchased and withdrawn from circulation 2,150,252 1,417,813 9,145,249 11,105,885 Shares in circulation at 31 December 55,827,264 57,977,516 566,432,055 575,577,304 Treasury shares 3,093,144 942,892 13,363,612 4,218,363 Number of shares issued at 31 December 58,920,408 58,920,408 579,795,667 579,795,667

BMW Group Report 2024 Page 305 Page 307

BMW Group Report 2024 Page 305 Page 307