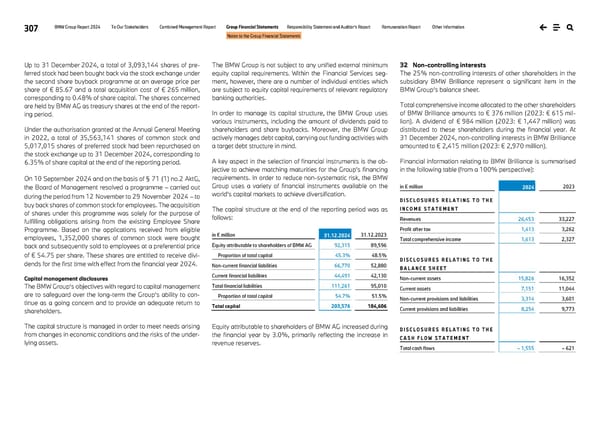

307 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Notes to the Group Financial Statements Up to 31 December 2024, a total of 3,093,144 shares of pre- ferred stock had been bought back via the stock exchange under the second share buyback programme at an average price per share of € 85.67 and a total acquisition cost of € 265 million, corresponding to 0.48% of share capital. The shares concerned are held by BMW AG as treasury shares at the end of the report- ing period. Under the authorisation granted at the Annual General Meeting in 2022, a total of 35,563,141 shares of common stock and 5,017,015 shares of preferred stock had been repurchased on the stock exchange up to 31 December 2024, corresponding to 6.35% of share capital at the end of the reporting period. On 10 September 2024 and on the basis of § 71 (1) no.2 AktG, the Board of Management resolved a programme – carried out during the period from 12 November to 29 November 2024 – to buy back shares of common stock for employees. The acquisition of shares under this programme was solely for the purpose of fulfilling obligations arising from the existing Employee Share Programme. Based on the applications received from eligible employees, 1,352,000 shares of common stock were bought back and subsequently sold to employees at a preferential price of € 54.75 per share. These shares are entitled to receive divi- dends for the first time with effect from the financial year 2024. Capital management disclosures The BMW Group’s objectives with regard to capital management are to safeguard over the long-term the Group’s ability to con- tinue as a going concern and to provide an adequate return to shareholders. The capital structure is managed in order to meet needs arising from changes in economic conditions and the risks of the under- lying assets. The BMW Group is not subject to any unified external minimum equity capital requirements. Within the Financial Services seg- ment, however, there are a number of individual entities which are subject to equity capital requirements of relevant regulatory banking authorities. In order to manage its capital structure, the BMW Group uses various instruments, including the amount of dividends paid to shareholders and share buybacks. Moreover, the BMW Group actively manages debt capital, carrying out funding activities with a target debt structure in mind. A key aspect in the selection of financial instruments is the ob- jective to achieve matching maturities for the Group’s financing requirements. In order to reduce non-systematic risk, the BMW Group uses a variety of financial instruments available on the world’s capital markets to achieve diversification. The capital structure at the end of the reporting period was as follows: in € million 31.12.2024 31.12.2023 Equity attributable to shareholders of BMW AG 92,315 89,596 Proportion of total capital 45.3% 48.5% Non-current financial liabilities 66,770 52,880 Current financial liabilities 44,491 42,130 Total financial liabilities 111,261 95,010 Proportion of total capital 54.7% 51.5% Total capital 203,576 184,606 Equity attributable to shareholders of BMW AG increased during the financial year by 3.0%, primarily reflecting the increase in revenue reserves. 32 Non-controlling interests The 25% non-controlling interests of other shareholders in the subsidiary BMW Brilliance represent a significant item in the BMW Group’s balance sheet. Total comprehensive income allocated to the other shareholders of BMW Brilliance amounts to € 376 million (2023: € 615 mil- lion). A dividend of € 984 million (2023: € 1,447 million) was distributed to these shareholders during the financial year. At 31 December 2024, non-controlling interests in BMW Brilliance amounted to € 2,415 million (2023: € 2,970 million). Financial information relating to BMW Brilliance is summarised in the following table (from a 100% perspective): in € million 2024 2023 D I S C L O S U R E S R E L A T I N G T O T H E I N C O M E S T A T E M E N T Revenues 26,453 33,227 Profit after tax 1,413 3,262 Total comprehensive income 1,613 2,327 D I S C L O S U R E S R E L A T I N G T O T H E B A L A N C E S H E E T Non-current assets 15,826 16,352 Current assets 7,151 11,044 Non-current provisions and liabilities 3,314 3,601 Current provisions and liabilities 8,254 9,773 D I S C L O S U R E S R E L A T I N G T O T H E C A S H F L O W S T A T E M E N T Total cash flows – 1,555 – 621

BMW Group Report 2024 Page 306 Page 308

BMW Group Report 2024 Page 306 Page 308