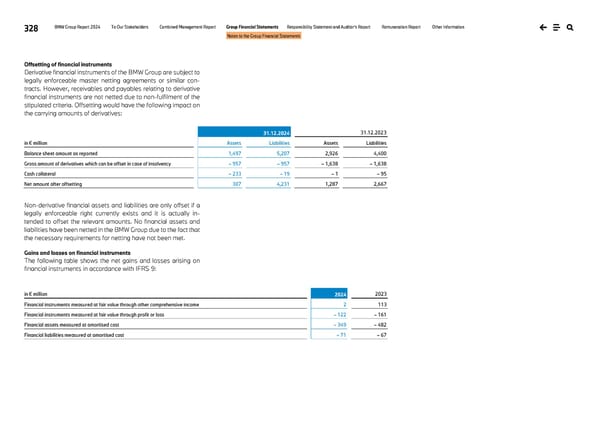

328 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Notes to the Group Financial Statements Offsetting of financial instruments Derivative financial instruments of the BMW Group are subject to legally enforceable master netting agreements or similar con- tracts. However, receivables and payables relating to derivative financial instruments are not netted due to non-fulfilment of the stipulated criteria. Offsetting would have the following impact on the carrying amounts of derivatives: 31.12.2024 31.12.2023 in € million Assets Liabilities Assets Liabilities Balance sheet amount as reported 1,497 5,207 2,926 4,400 Gross amount of derivatives which can be offset in case of insolvency – 957 – 957 – 1,638 – 1,638 Cash collateral – 233 – 19 – 1 – 95 Net amount after offsetting 307 4,231 1,287 2,667 Non-derivative financial assets and liabilities are only offset if a legally enforceable right currently exists and it is actually in- tended to offset the relevant amounts. No financial assets and liabilities have been netted in the BMW Group due to the fact that the necessary requirements for netting have not been met. Gains and losses on financial instruments The following table shows the net gains and losses arising on financial instruments in accordance with IFRS 9: in € million 2024 2023 Financial instruments measured at fair value through other comprehensive income 2 113 Financial instruments measured at fair value through profit or loss – 122 – 161 Financial assets measured at amortised cost – 349 – 482 Financial liabilities measured at amortised cost – 71 – 67

BMW Group Report 2024 Page 327 Page 329

BMW Group Report 2024 Page 327 Page 329