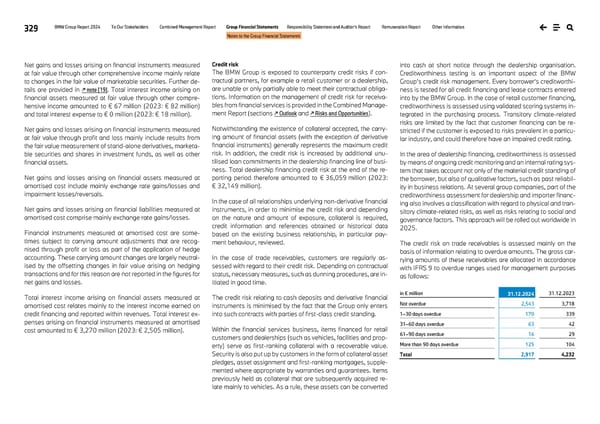

329 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Notes to the Group Financial Statements Net gains and losses arising on financial instruments measured at fair value through other comprehensive income mainly relate to changes in the fair value of marketable securities. Further de- tails are provided in ↗ note [19]. Total interest income arising on financial assets measured at fair value through other compre- hensive income amounted to € 67 million (2023: € 82 million) and total interest expense to € 0 million (2023: € 18 million). Net gains and losses arising on financial instruments measured at fair value through profit and loss mainly include results from the fair value measurement of stand-alone derivatives, marketa- ble securities and shares in investment funds, as well as other financial assets. Net gains and losses arising on financial assets measured at amortised cost include mainly exchange rate gains/losses and impairment losses/reversals. Net gains and losses arising on financial liabilities measured at amortised cost comprise mainly exchange rate gains/losses. Financial instruments measured at amortised cost are some- times subject to carrying amount adjustments that are recog- nised through profit or loss as part of the application of hedge accounting. These carrying amount changes are largely neutral- ised by the offsetting changes in fair value arising on hedging transactions and for this reason are not reported in the figures for net gains and losses. Total interest income arising on financial assets measured at amortised cost relates mainly to the interest income earned on credit financing and reported within revenues. Total interest ex- penses arising on financial instruments measured at amortised cost amounted to € 3,270 million (2023: € 2,505 million). Credit risk The BMW Group is exposed to counterparty credit risks if con- tractual partners, for example a retail customer or a dealership, are unable or only partially able to meet their contractual obliga- tions. Information on the management of credit risk for receiva- bles from financial services is provided in the Combined Manage- ment Report (sections ↗ Outlook and ↗ Risks and Opportunities). Notwithstanding the existence of collateral accepted, the carry- ing amount of financial assets (with the exception of derivative financial instruments) generally represents the maximum credit risk. In addition, the credit risk is increased by additional unu- tilised loan commitments in the dealership financing line of busi- ness. Total dealership financing credit risk at the end of the re- porting period therefore amounted to € 36,059 million (2023: € 32,149 million). In the case of all relationships underlying non-derivative financial instruments, in order to minimise the credit risk and depending on the nature and amount of exposure, collateral is required, credit information and references obtained or historical data based on the existing business relationship, in particular pay- ment behaviour, reviewed. In the case of trade receivables, customers are regularly as- sessed with regard to their credit risk. Depending on contractual status, necessary measures, such as dunning procedures, are in- itiated in good time. The credit risk relating to cash deposits and derivative financial instruments is minimised by the fact that the Group only enters into such contracts with parties of first-class credit standing. Within the financial services business, items financed for retail customers and dealerships (such as vehicles, facilities and prop- erty) serve as first-ranking collateral with a recoverable value. Security is also put up by customers in the form of collateral asset pledges, asset assignment and first-ranking mortgages, supple- mented where appropriate by warranties and guarantees. Items previously held as collateral that are subsequently acquired re- late mainly to vehicles. As a rule, these assets can be converted into cash at short notice through the dealership organisation. Creditworthiness testing is an important aspect of the BMW Group’s credit risk management. Every borrower’s creditworthi- ness is tested for all credit financing and lease contracts entered into by the BMW Group. In the case of retail customer financing, creditworthiness is assessed using validated scoring systems in- tegrated in the purchasing process. Transitory climate-related risks are limited by the fact that customer financing can be re- stricted if the customer is exposed to risks prevalent in a particu- lar industry, and could therefore have an impaired credit rating. In the area of dealership financing, creditworthiness is assessed by means of ongoing credit monitoring and an internal rating sys- tem that takes account not only of the material credit standing of the borrower, but also of qualitative factors, such as past reliabil- ity in business relations. At several group companies, part of the creditworthiness assessment for dealership and importer financ- ing also involves a classification with regard to physical and tran- sitory climate-related risks, as well as risks relating to social and governance factors. This approach will be rolled out worldwide in 2025. The credit risk on trade receivables is assessed mainly on the basis of information relating to overdue amounts. The gross car- rying amounts of these receivables are allocated in accordance with IFRS 9 to overdue ranges used for management purposes as follows: in € million 31.12.2024 31.12.2023 Not overdue 2,543 3,718 1–30 days overdue 170 339 31–60 days overdue 63 42 61–90 days overdue 16 29 More than 90 days overdue 125 104 Total 2,917 4,232

BMW Group Report 2024 Page 328 Page 330

BMW Group Report 2024 Page 328 Page 330