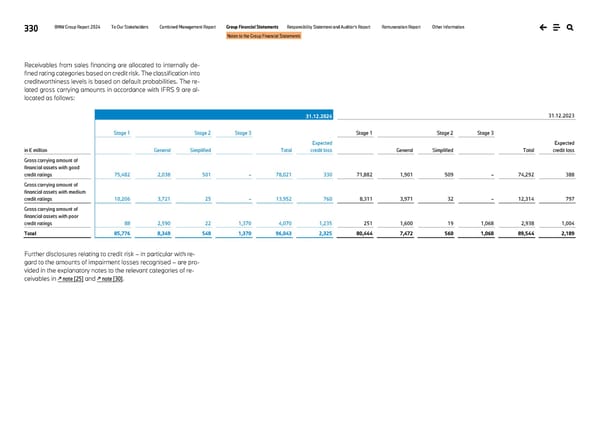

330 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Notes to the Group Financial Statements Receivables from sales financing are allocated to internally de- fined rating categories based on credit risk. The classification into creditworthiness levels is based on default probabilities. The re- lated gross carrying amounts in accordance with IFRS 9 are al- located as follows: 31.12.2024 31.12.2023 Stage 1 Stage 2 Stage 3 Stage 1 Stage 2 Stage 3 in € million General Simplified Total Expected credit loss General Simplified Total Expected credit loss Gross carrying amount of financial assets with good credit ratings 75,482 2,038 501 – 78,021 330 71,882 1,901 509 – 74,292 388 Gross carrying amount of financial assets with medium credit ratings 10,206 3,721 25 – 13,952 760 8,311 3,971 32 – 12,314 797 Gross carrying amount of financial assets with poor credit ratings 88 2,590 22 1,370 4,070 1,235 251 1,600 19 1,068 2,938 1,004 Total 85,776 8,349 548 1,370 96,043 2,325 80,444 7,472 560 1,068 89,544 2,189 Further disclosures relating to credit risk – in particular with re- gard to the amounts of impairment losses recognised – are pro- vided in the explanatory notes to the relevant categories of re- ceivables in ↗ note [25] and ↗ note [30].

BMW Group Report 2024 Page 329 Page 331

BMW Group Report 2024 Page 329 Page 331