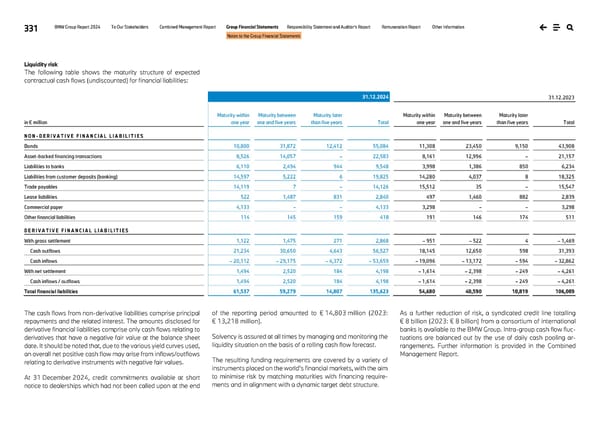

331 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Notes to the Group Financial Statements Liquidity risk The following table shows the maturity structure of expected contractual cash flows (undiscounted) for financial liabilities: 31.12.2024 31.12.2023 in € million Maturity within one year Maturity between one and five years Maturity later than five years Total Maturity within one year Maturity between one and five years Maturity later than five years Total N O N - D E R I V A T I V E F I N A N C I A L L I A B I L I T I E S Bonds 10,800 31,872 12,412 55,084 11,308 23,450 9,150 43,908 Asset-backed financing transactions 8,526 14,057 – 22,583 8,161 12,996 – 21,157 Liabilities to banks 6,110 2,494 944 9,548 3,998 1,386 850 6,234 Liabilities from customer deposits (banking) 14,597 5,222 6 19,825 14,280 4,037 8 18,325 Trade payables 14,119 7 – 14,126 15,512 35 – 15,547 Lease liabilities 522 1,487 831 2,840 497 1,460 882 2,839 Commercial paper 4,133 – – 4,133 3,298 – – 3,298 Other financial liabilities 114 145 159 418 191 146 174 511 D E R I V A T I V E F I N A N C I A L L I A B I L I T I E S With gross settlement 1,122 1,475 271 2,868 – 951 – 522 4 – 1,469 Cash outflows 21,234 30,650 4,643 56,527 18,145 12,650 598 31,393 Cash inflows – 20,112 – 29,175 – 4,372 – 53,659 – 19,096 – 13,172 – 594 – 32,862 With net settlement 1,494 2,520 184 4,198 – 1,614 – 2,398 – 249 – 4,261 Cash inflows / outflows 1,494 2,520 184 4,198 – 1,614 – 2,398 – 249 – 4,261 Total financial liabilities 61,537 59,279 14,807 135,623 54,680 40,590 10,819 106,089 The cash flows from non-derivative liabilities comprise principal repayments and the related interest. The amounts disclosed for derivative financial liabilities comprise only cash flows relating to derivatives that have a negative fair value at the balance sheet date. It should be noted that, due to the various yield curves used, an overall net positive cash flow may arise from inflows/outflows relating to derivative instruments with negative fair values. At 31 December 2024, credit commitments available at short notice to dealerships which had not been called upon at the end of the reporting period amounted to € 14,803 million (2023: € 13,218 million). Solvency is assured at all times by managing and monitoring the liquidity situation on the basis of a rolling cash flow forecast. The resulting funding requirements are covered by a variety of instruments placed on the world’s financial markets, with the aim to minimise risk by matching maturities with financing require- ments and in alignment with a dynamic target debt structure. As a further reduction of risk, a syndicated credit line totalling € 8 billion (2023: € 8 billion) from a consortium of international banks is available to the BMW Group. Intra-group cash flow fluc- tuations are balanced out by the use of daily cash pooling ar- rangements. Further information is provided in the Combined Management Report.

BMW Group Report 2024 Page 330 Page 332

BMW Group Report 2024 Page 330 Page 332