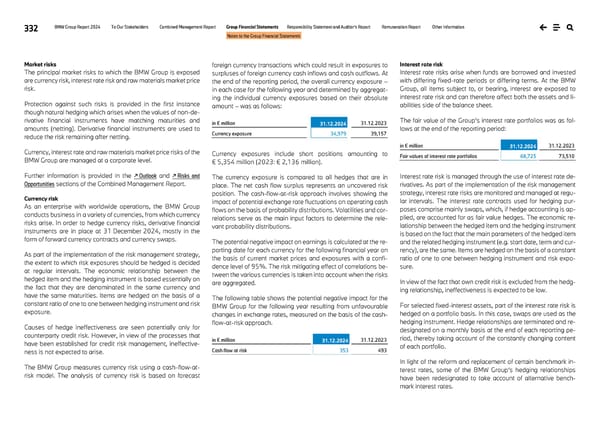

332 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Notes to the Group Financial Statements Market risks The principal market risks to which the BMW Group is exposed are currency risk, interest rate risk and raw materials market price risk. Protection against such risks is provided in the first instance though natural hedging which arises when the values of non-de- rivative financial instruments have matching maturities and amounts (netting). Derivative financial instruments are used to reduce the risk remaining after netting. Currency, interest rate and raw materials market price risks of the BMW Group are managed at a corporate level. Further information is provided in the ↗ Outlook and ↗ Risks and Opportunities sections of the Combined Management Report. Currency risk As an enterprise with worldwide operations, the BMW Group conducts business in a variety of currencies, from which currency risks arise. In order to hedge currency risks, derivative financial instruments are in place at 31 December 2024, mostly in the form of forward currency contracts and currency swaps. As part of the implementation of the risk management strategy, the extent to which risk exposures should be hedged is decided at regular intervals. The economic relationship between the hedged item and the hedging instrument is based essentially on the fact that they are denominated in the same currency and have the same maturities. Items are hedged on the basis of a constant ratio of one to one between hedging instrument and risk exposure. Causes of hedge ineffectiveness are seen potentially only for counterparty credit risk. However, in view of the processes that have been established for credit risk management, ineffective- ness is not expected to arise. The BMW Group measures currency risk using a cash-flow-at- risk model. The analysis of currency risk is based on forecast foreign currency transactions which could result in exposures to surpluses of foreign currency cash inflows and cash outflows. At the end of the reporting period, the overall currency exposure – in each case for the following year and determined by aggregat- ing the individual currency exposures based on their absolute amount – was as follows: in € million 31.12.2024 31.12.2023 Currency exposure 34,979 39,157 Currency exposures include short positions amounting to € 5,354 million (2023: € 2,136 million). The currency exposure is compared to all hedges that are in place. The net cash flow surplus represents an uncovered risk position. The cash-flow-at-risk approach involves showing the impact of potential exchange rate fluctuations on operating cash flows on the basis of probability distributions. Volatilities and cor- relations serve as the main input factors to determine the rele- vant probability distributions. The potential negative impact on earnings is calculated at the re- porting date for each currency for the following financial year on the basis of current market prices and exposures with a confi- dence level of 95%. The risk mitigating effect of correlations be- tween the various currencies is taken into account when the risks are aggregated. The following table shows the potential negative impact for the BMW Group for the following year resulting from unfavourable changes in exchange rates, measured on the basis of the cash- flow-at-risk approach. in € million 31.12.2024 31.12.2023 Cash flow at risk 353 493 Interest rate risk Interest rate risks arise when funds are borrowed and invested with differing fixed-rate periods or differing terms. At the BMW Group, all items subject to, or bearing, interest are exposed to interest rate risk and can therefore affect both the assets and li- abilities side of the balance sheet. The fair value of the Group’s interest rate portfolios was as fol- lows at the end of the reporting period: in € million 31.12.2024 31.12.2023 Fair values of interest rate portfolios 68,725 73,510 Interest rate risk is managed through the use of interest rate de- rivatives. As part of the implementation of the risk management strategy, interest rate risks are monitored and managed at regu- lar intervals. The interest rate contracts used for hedging pur- poses comprise mainly swaps, which, if hedge accounting is ap- plied, are accounted for as fair value hedges. The economic re- lationship between the hedged item and the hedging instrument is based on the fact that the main parameters of the hedged item and the related hedging instrument (e.g. start date, term and cur- rency), are the same. Items are hedged on the basis of a constant ratio of one to one between hedging instrument and risk expo- sure. In view of the fact that own credit risk is excluded from the hedg- ing relationship, ineffectiveness is expected to be low. For selected fixed-interest assets, part of the interest rate risk is hedged on a portfolio basis. In this case, swaps are used as the hedging instrument. Hedge relationships are terminated and re- designated on a monthly basis at the end of each reporting pe- riod, thereby taking account of the constantly changing content of each portfolio. In light of the reform and replacement of certain benchmark in- terest rates, some of the BMW Group’s hedging relationships have been redesignated to take account of alternative bench- mark interest rates.

BMW Group Report 2024 Page 331 Page 333

BMW Group Report 2024 Page 331 Page 333