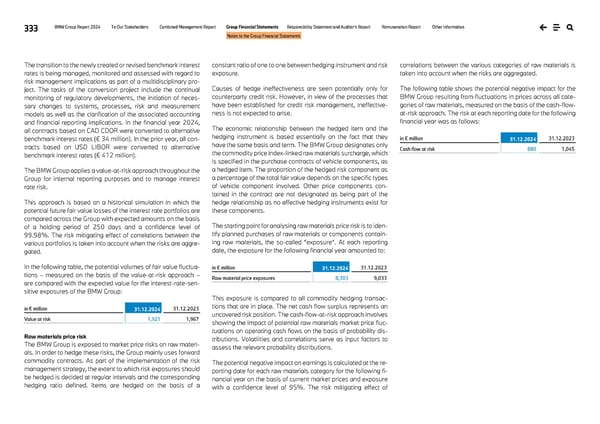

333 BMW Group Report 2024 To Our Stakeholders Combined Management Report Group Financial Statements Responsibility Statement and Auditor’s Report Remuneration Report Other Information Notes to the Group Financial Statements The transition to the newly created or revised benchmark interest rates is being managed, monitored and assessed with regard to risk management implications as part of a multidisciplinary pro- ject. The tasks of the conversion project include the continual monitoring of regulatory developments, the initiation of neces- sary changes to systems, processes, risk and measurement models as well as the clarification of the associated accounting and financial reporting implications. In the financial year 2024, all contracts based on CAD CDOR were converted to alternative benchmark interest rates (€ 34 million). In the prior year, all con- tracts based on USD LIBOR were converted to alternative benchmark interest rates (€ 412 million). The BMW Group applies a value-at-risk approach throughout the Group for internal reporting purposes and to manage interest rate risk. This approach is based on a historical simulation in which the potential future fair value losses of the interest rate portfolios are compared across the Group with expected amounts on the basis of a holding period of 250 days and a confidence level of 99.98%. The risk mitigating effect of correlations between the various portfolios is taken into account when the risks are aggre- gated. In the following table, the potential volumes of fair value fluctua- tions – measured on the basis of the value-at-risk approach – are compared with the expected value for the interest-rate-sen- sitive exposures of the BMW Group: in € million 31.12.2024 31.12.2023 Value at risk 1,921 1,967 Raw materials price risk The BMW Group is exposed to market price risks on raw materi- als. In order to hedge these risks, the Group mainly uses forward commodity contracts. As part of the implementation of the risk management strategy, the extent to which risk exposures should be hedged is decided at regular intervals and the corresponding hedging ratio defined. Items are hedged on the basis of a constant ratio of one to one between hedging instrument and risk exposure. Causes of hedge ineffectiveness are seen potentially only for counterparty credit risk. However, in view of the processes that have been established for credit risk management, ineffective- ness is not expected to arise. The economic relationship between the hedged item and the hedging instrument is based essentially on the fact that they have the same basis and term. The BMW Group designates only the commodity price index-linked raw materials surcharge, which is specified in the purchase contracts of vehicle components, as a hedged item. The proportion of the hedged risk component as a percentage of the total fair value depends on the specific types of vehicle component involved. Other price components con- tained in the contract are not designated as being part of the hedge relationship as no effective hedging instruments exist for these components. The starting point for analysing raw materials price risk is to iden- tify planned purchases of raw materials or components contain- ing raw materials, the so-called “exposure”. At each reporting date, the exposure for the following financial year amounted to: in € million 31.12.2024 31.12.2023 Raw material price exposures 8,303 9,033 This exposure is compared to all commodity hedging transac- tions that are in place. The net cash flow surplus represents an uncovered risk position. The cash-flow-at-risk approach involves showing the impact of potential raw materials market price fluc- tuations on operating cash flows on the basis of probability dis- tributions. Volatilities and correlations serve as input factors to assess the relevant probability distributions. The potential negative impact on earnings is calculated at the re- porting date for each raw materials category for the following fi- nancial year on the basis of current market prices and exposure with a confidence level of 95%. The risk mitigating effect of correlations between the various categories of raw materials is taken into account when the risks are aggregated. The following table shows the potential negative impact for the BMW Group resulting from fluctuations in prices across all cate- gories of raw materials, measured on the basis of the cash-flow- at-risk approach. The risk at each reporting date for the following financial year was as follows: in € million 31.12.2024 31.12.2023 Cash flow at risk 880 1,045

BMW Group Report 2024 Page 332 Page 334

BMW Group Report 2024 Page 332 Page 334